If you’re asking yourself if you should get a commission advance and your bank account is low, then you probably need to get a commission advance. Advances can be used for business purposes such as expanding your marketing budget, promotional materials, car expenses, staging and other related real estate activity.

Can you get a commission advance if you are a buyer’s agent?

As a buyer’s agent, you can get a commission advance. The transaction isn’t as strong as a listing agent’s transaction, but Express Cash Flow can still advance on it.

How can I get an advance on unearned sales commission?

Unearned sales commission can be paid out on transactions under contract and on active listings. Funding can take as short as 1 hour and can be funded via wire, Zelle or Venmo.

eXp Realty Agents Build Wealth Through Multiple Levers Including Commission, Revenue Share, and Stock Offerings in 2021

eXp Realty has been focused on innovating and supporting agents in a virtual world since the very beginning. That’s why the brokerage has built its foundation on a state-of-the-art online platform to eliminate the traditional brick-and-mortar offices in favor of a cloud-based brokerage. That way, eXp can offer agents equal opportunity to build true wealth through virtually limitless earning potential. Every other real estate broker out there allows you to build one single income stream that comes from trading your time for money. Therefore, as soon as you stop showing properties all day long or stop picking up the phone late at night, you will stop receiving income. With eXp, you have most advantageous capped commission structure to build a successful real estate career then add in a passive income stream through revenue sharing program and become shareholders at eXp Realty in a variety of ways.

In this article, we will cover the following:

- eXp Commission – Equal Opportunity

- Transaction Fees

- Revenue Share

- eXp Stock Ownership

- Other Fees

- ICON program

eXp Realty Commission: Every Agent Has the Same Commission Structure at eXp

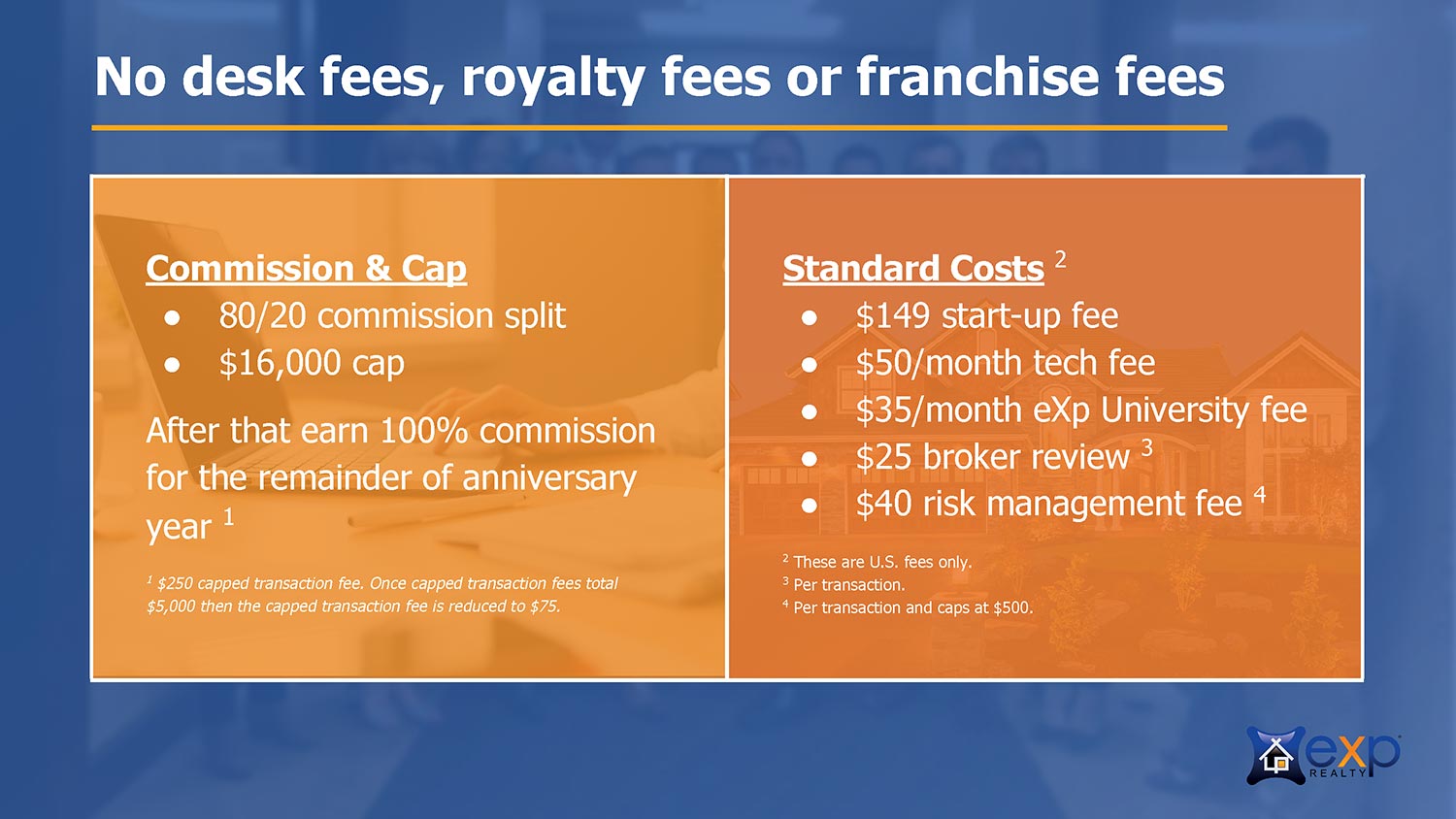

Unlike traditional brokerages where commissions are variable and often depend on an agent’s negotiating skills, production or relationships, all agents at eXp get the same commission structure: 80/20 with a $16,000 cap. Team members are eligible for one-half to a one-quarter cap, based on team performance.

That means agents at eXp keep 80% of the commission earned until they have paid a total of $16,000. After that, the agent keeps the entire commission (100%) for the duration of their anniversary year. There are no franchise or royalty fees charged at eXp Realty.

Transactional fees, charged only for closed sales, cover the broker review ($25) and risk management fee ($40) together capped at $500 per year.

See examples below for how commissions and costs break down.

The risk management fee caps at $500 and then goes to $0. The capped transaction fee reduces to $75 per transaction after $5,000 has been paid.

Example 1: Commission and fees for a $350,000 closing with 3% commission for an agent who has not reached the $16,000 cap:

Gross Commission = $10,500

- Deduct eXp Company Dollar = $2,100 (20%)

- Deduct Broker/Risk Fees = $65

Agent Net Commission = $8,335

Example 2: Commission and fees for a $350,000 closing with 3% commission for an agent who has reached the $16,000 cap:

Gross Commission = $10,500

- Deduct eXp Company Dollar = $0

- Deduct Capped Transaction Fee = $250

- Deduct Broker/Risk Fees = $65

Agent Net Commission = $10,185

eXp Realty Transaction Fees

After a real estate agent caps, they go to 100 percent and only pay $250 per transaction. If an agent pays in $5,000 in transaction fees after capping, they will move to a $75 per transaction fee for the remainder of the anniversary year.

For example, let’s say you sell 60 homes in one year with an average commission amount of $6,000 per transaction. Here is how your eXp Realty commission split would work out:

- Transactions 1-14 would be on an 80/20 split with NO transaction fee.

- Transactions 15-34 would be on a 100/0 split with a $250 transaction fee.

Transactions 35-60 would be on a 100/0 split with a $75 transaction fee.

To explain, you would cap on your 14th transaction ($6,000 x 14 transactions = $84,000). Transactions 15-34 would all be at $250/per transaction totaling $5,000. Transactions 35-60 would be at $75 per transaction.

eXp Revenue Share: Agents Earn Revenue Share Through Sponsored Agents

Perhaps one of the most exciting, yet misunderstood benefits at eXp is revenue share. The revenue share opportunity is simply when an agent joins eXp and names an active eXp agent as their “sponsor.” The sponsor is the eXp agent who was most influential in the new agent’s decision to join eXp.

Once the new agent begins closing on transactions, the sponsor receives a percentage of the company dollar (revenue) from the sales activity of their sponsored agent. It is based on gross commission income (GCI), and is dynamically calculated and paid monthly.

This is a different concept than profit-sharing, in which certain brokerages share company profits with agents after all expenses have been subtracted from revenue. That includes costs such as rent, insurance, utilities, staff salaries, and other costly overhead charges. In a profit-share model, it often happens that a sponsored agent is productive but the office or franchise is not profitable, resulting in minimal or zero profit-share.

eXp Stock: eXp Agents Can Acquire Stock in a Variety of Ways

The third unique form of compensation for agents at eXp is becoming a shareholder with the company. eXp Realty agents are awarded or can earn shares of stock in eXp World Holdings (eXp Realty’s parent company) after certain milestones are reached, including:

- Closing on the first transaction as an eXp Realty agent ($200 stock award)

- The first closed transaction by any agent they have sponsored ($400 stock award)

- Reaching the annual cap ($400 stock award)

- Reaching ICON Agent status ($16,000 stock award)

- Agents can also elect to receive up to 5% of their commissions from each closed sale in the form of eXp stock at a 10% discount through the Agent Equity Program.

Other eXp Fees

eXp Realty fees consist of monthly and transaction fees. I’ll cover each in more detail below.

eXp Realty does not charge a desk fee, royalty fee, or franchise fee. Also, there are no minimum production or attraction requirements. So long as you stay current on your $85 monthly fee and all state licensing requirements you can remain licensed at eXp Realty.

Risk Management Fee (Errors & Omissions)

Many agents are familiar with the term errors and omissions. At eXp Realty, we call this the risk management fee. The risk management fee varies by country, but in the US, it is $40 per transaction.

Once a real estate agent hits $500 in risk management fees paid for the year, the agent will no longer pay risk management fees for the remainder of the anniversary year.

Broker Review Fee

All US agents pay a $25 per transaction broker review fee.

This fee does not cap.

eXp Realty Mentor Fees

Agents who’ve completed less than three transactions in their current market will be enrolled in the eXp Realty’s mentor program. Agents in the mentor program are assigned a certified mentor who will help assist with the agent’s first three transactions at eXp Realty.

Mentees pay an additional 20 percent split on these first three transactions which pays the mentor and mentor program (which consists of additional training modules for the mentee).

Once the mentee closes three transactions with eXp Realty, they graduate from the mentor program and are not subject to the additional 20 percent commission split.

eXp Realty Seller Fees

eXp Realty does not charge any additional fees to clients. Agents can determine their commission rate and any additional fees to their clients. However, whatever rate and fees that are charged to the client are then split with eXp Realty at the typical commission split.

If an agent wishes to discount their commission rate and that agent has not reached their commission cap, the minimum transaction split to eXp Realty is $500. Therefore, an agent can reduce their commission completely to $0 to the client but the agent would then be responsible to pay eXp Realty $500 for that transaction, plus the broker review and risk management fee.

eXp Realty Personal Deals

At eXp Realty, agents can complete three personal transactions per year without paying the 20 percent split to eXp Realty.

Agents are only responsible to pay a $250 transaction fee, $40 risk management fee, and $25 broker review fee for the personal deal.

A personal transaction consists of only the deals for which the eXp Realty agent is personally on the contract.

Commission Split and Fees Example on 60 Transaction for the Year

Their total eXp Realty Commission Split paid for the year would equal:

- $16,000 – Cap

- $5,000 – $250 Transaction Fees

- $1,875 – $75 Transaction Fees

- $500 – Risk Management Fees

- $1,500 – Broker Review Fees

- $24,875 – Total eXp Realty Commission Split Fees

How would you like to earn $16,000 of those fees back? Read below about the ICON agent program at eXp Realty and see how you can do just that.

$500,000 Annual Gross Commission Income Plus ICON Qualifying Fee

The second way you could qualify to become an ICON agent is by achieving an “Annual gross commission income of $500,000 or more with a minimum of 10 closed transactions and payment of an “ICON Qualifying Fee.” This fee is equal to $5,000 less capped transaction fees paid during the same anniversary year.

The last part of becoming an ICON agent is to” Demonstrate company culture by giving back by teaching a class, serving on a panel, or serving on a committee. Also, an ICON agent must have a willingness to promote eXp Realty within their community.”

That’s it! Once you’ve accomplished the above requirements, you would earn $8,000 in publicly traded eXp World Holdings (EXPI) common stock. This stock vests after three years.

You would acquire an additional $4,000 after one year, once your cultural requirements are fulfilled and verified.

ICON agents earn the last $4,000 in stock awards after attending each of the two annual eXp Realty events .

The company issues $2,000 after each company event (The eXp Shareholder Summit and EXPCON ) with no vesting period, for a possible total of $4,000 from attending the company events.

Wrapping Things Up

In conclusion, the eXp Realty Commission Split is very generous compared to the majority of brokerages out there. Especially when you consider the ICON Agent Program, eXp Realty is genuinely unique. Combine this with all the tools and training that eXp Realty provides to real estate agents, and you get an excellent opportunity to grow your career in real estate.

Do you have any questions related to the eXp Realty Commission Split? Put them in the comments below and I would be happy to answer them! Also visit Express Cash Flow.

Re/Max: Real estate expected to boom in 2018

After a year of rising home prices, low inventory levels and ongoing homebuyer demand, these conditions will increase even more in 2018.

As the year begins, one expert breaks down some of the major trends to come in 2018, saying the year will bring an abundance of positive trends.

“Turn up the volume on new home building,” Re/Max Co-CEO Adam Contos said, citing housing starts that are down 2.9% year-over-year and well below the historic 50-year average. “We’d love nothing more than to see the next generation of homebuyers start building equity now.”

Contos gives these four predictions for 2018:

1. Inventory is key

Contos explained that the volume on new home building will increase, but until that happens, the market will struggle with low inventory and some markets will feature all-out bidding wars. In 2017, housing starts were down 2.9% year-over-year and well below the historic 50-year average. Even though there’s a shortage of l

abor and a spike in material costs, the primary reason for the low starts is that builders have focused on more profitable, higher priced homes and multi-family residential construction. But now, at the end of the year, single-family homebuilding and permits began to surge, he pointed out, saying he would like to see that trend continue.

2. Existing home sales on the rise

Fueled by renewed consumer confidence, wage growth and an improving economy, existing home sales could increase and may even surpass record levels set back in 2006. However, any negative impacts on the stock market, even tighter inventories, a repeat of 2017’s devastating hurricanes and fires or even the recently signed tax reform bill could slow down home sales.

3. Changing migration patterns

Home buyers discouraged by affordability and low inventory in certain cities, markets and states, will look to other, more attractive and more inviting neighborhoods. Contos said he expects to see more home sales in the suburbs, less-populated markets and even more affordable states. Cities that have the most effective transportation systems and those that promote high-amenity, “walkable,” contemporary neighborhoods will benefit the most.

4. Always the unexpected

Gadgets, apps, online tools, real estate agents and technology – anything that makes buying and selling a home more plausible and less stressful will continue to launch and evolve, especially in 2018. He predicted consumers may not use bitcoins to buy a home tomorrow, but that could be in the future.

“We’ll certainly see our share of challenges in 2018,” Contos said. “But with the challenges will come ecstatic home buyers and sellers, new and booming communities, one boasting the new Amazon headquarters, and fresh innovations in real estate that we never saw coming.”

To see more forecasts for 2018, click here. Source: Housingwire

What’s More Valuable to a Realtor- Listing or Buyer?

What, though, is more efficient, between a new buyer client and a new seller client?

To even the playing field a bit, let’s focus on deals that are otherwise equal. We are going to operate in a vacuum- it isn’t a buyer’s market, it isn’t a seller’s market, and the hypothetical buyer and listing are going to be the around the same dollar amount. So, is a $1 Million buyer or listing more valuable to a realtor?

First, let’s consider a million dollar buyer. This is probably not their first home purchase, and they probably have excellent credit. This puts them at the top of the list that most agents would want to work with. However, buyers are time consuming. Even with today’s technology, people like to walk through homes to get the best possible feel for them. It is very rare for someone to buy the home they plan to live in without personally visiting it first.

This process is not very efficient for an agent, as they will be driving around with the clients to a number of homes that will not be bought. What’s more, sellers in this price range are generally not distressed, so negotiating can be a painstaking process. You have to have a firm commitment and understanding of your client in order to be a successful buyer’s agent.

Not to mention, the buyer’s agent will also need to get their client through all of the hurdles necessary to purchase home, including:

• Mortgage pre-approval and underwriting

• Physical inspection of property (and possibly additional specialty inspections)

• Lender appraisal

• Negotiation with seller

Working for a seller, though, allows an agent to be more flexible. Once the listing agreement is signed, most tasks can be given to an agent’s assistant, and the agent doesn’t need to spend as much face time with the client. The expectations can be greater, and the stakes are certainly higher, but there is also much more to be gained. Listings help create and add to the agent’s brand in a way that buyers never will. With open houses and mailers that go out to the surrounding neighbors, a listing is far more likely to generate new business than a buyer is. Commission advance companies, like Express Cash Flow, will even advance portions of the agent’s commission on certain listings.

So, it is settled. It is far more efficient and profitable for an agent to be working with a listing than a buyer. Agents should devote their time and resources to securing as many listings as possible, and work with the buyers that come their way organically or by referral.

About Us:

Express Cash Flow provides commission advances for real estate agents and brokers. Check us out at www.ExpressCashFlow.com or call us at 844-818-2274.