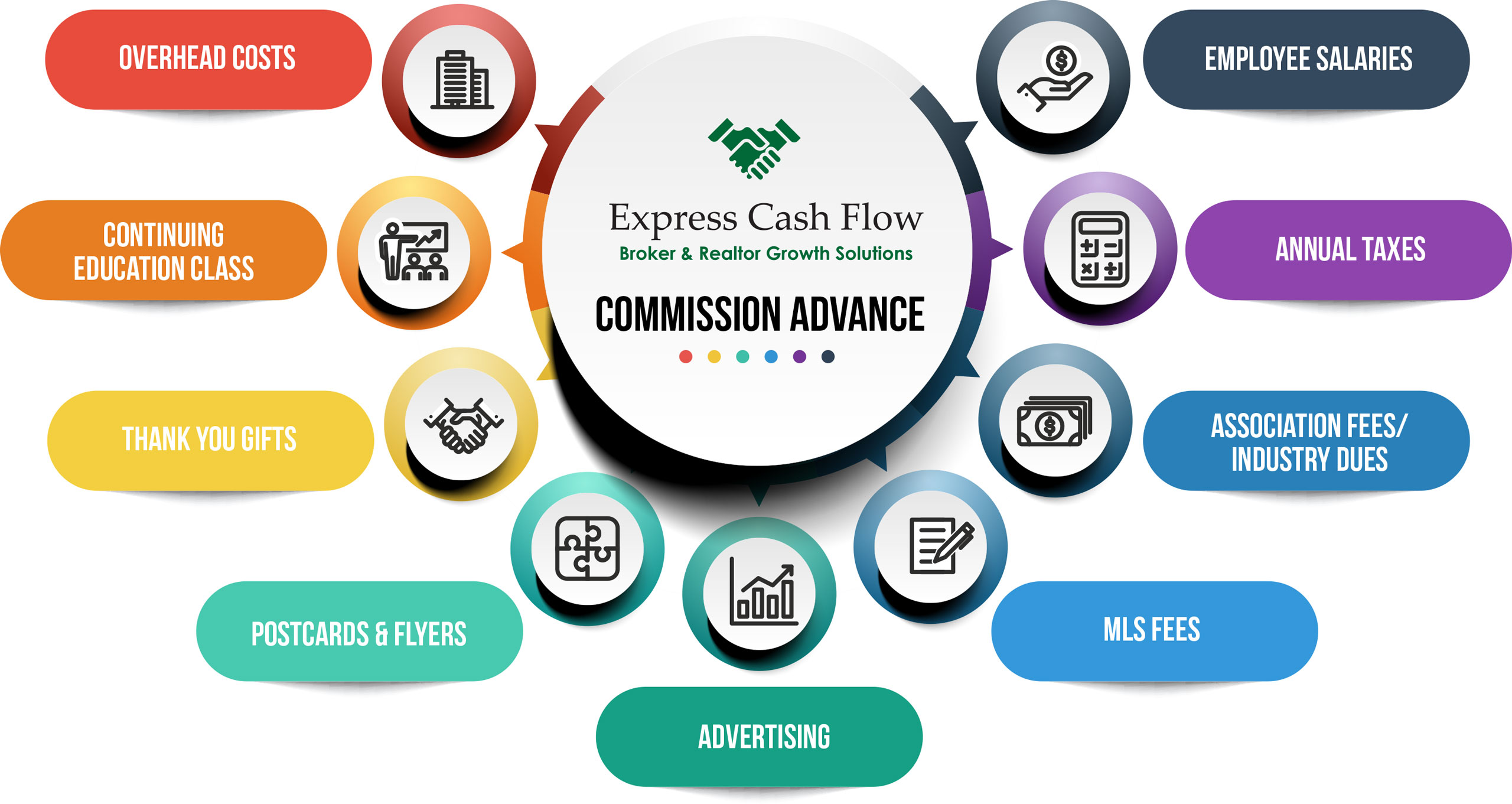

If you’re asking yourself if you should get a commission advance and your bank account is low, then you probably need to get a commission advance. Advances can be used for business purposes such as expanding your marketing budget, promotional materials, car expenses, staging and other related real estate activity.

Can you get a commission advance if you are a buyer’s agent?

As a buyer’s agent, you can get a commission advance. The transaction isn’t as strong as a listing agent’s transaction, but Express Cash Flow can still advance on it.

Do I pay Taxes on a Commission Advance?

You do NOT have to pay taxes on a Commission Advance. Commission Advance fees are tax deductible if the proceeds are used or business purposes.

Commission Advance Fees are Tax Deductible

If commission advance proceeds are used for business purposes, they are considered a tax-deductible business expense. The commission advance fees are similar to interest costs on a loan. Agents and brokers should include an itemized summary with their tax return detailing all advance fees paid to any commission advance service provider they used in the year. If you use Express Cash Flow for your commission advance provider, we will always provide you a statement of all advances taken in a given year or years within 24 hours.

As an independent contractor, owner of an LLC or Corporation, the fees you pay to secure a commission advance are a fully deductible business expense. It’s a true cost of doing business. For sole proprietors, this means recording the fees as a business expense on Schedule C of your tax return.

Business Expenses

Further benefits when receiving a commission advance is the fact that business expenses paid for with your advance proceeds are also tax deductible. For example, say you use a portion of your commission advance to pay for office rent. That rent payment is a tax-deductible expense, even though you used your commission advance to make the payment. The same holds true for any other legitimate business expense, such as purchasing marketing materials, car related expenses and meals.

What are the advantages of using Express Cash Flow for Real Estate Commission Advances:

Since 2015, Express Cash Flow has helped real estate agents and brokers balance their cash flow between closings. Express Cash Flow can pay you now on a pending transaction to help you grow your business.

- Low rates

- Experienced and trusted partner

- Advance up to 75% of your net commissions

- No credit checks

- Real-time processing

- Personalized Experience

- Multiple advances at one time

Please visit Application page to get your commission before closing.

Do Brokers have to sign Commission Advances?

A common question commission advance companies get is “Do Brokers have to sign Commission Advances?”. The answer is yes because legally under the contract the Broker is owned the commission. You and the broker have a separate agreement outlining your split.

Express Cash Flow offers the Best Commission Advances

Express Cash Flow offers the best Commission Advances nationwide. Agent and broker real estate commission advances can be used for business purposes such as expanding your marketing budget, promotional materials, car expenses, staging and other related real estate activity.

Are commission advance fees tax deductible?

Are commission fees tax deductible? The answer is yes if your commission advance proceeds are used for your business expenses, the costs are tax deductible. You may opt to use Express Cash Flow on every transaction or just when there are more bills than commission.

Commission Advance Fee Tax Deductibility

Because commission advances are used for business purposes, they are considered a tax-deductible business expense. The commission advance fees are similar to interest costs on a loan. Agents and brokers should include an itemized summary with their tax return detailing all advance fees paid to any commission advance service provider they used in the year.

As an independent contractor, owner of an LLC or Corporation, the fees you pay to secure a commission advance are a fully deductible business expense. It’s a true cost of doing business. For sole proprietors, this means recording the fees as a business expense on Schedule C of your tax return.

Business Expenses

Further benefits when receiving a commission advance is the fact that business expenses paid for with your advance proceeds are also tax deductible. For example, say you use a portion of your commission advance to pay for office rent. That rent payment is a tax-deductible expense, even though you used your commission advance to make the payment. The same holds true for any other legitimate business expense, such as purchasing marketing materials, car related expenses and meals.

Personal versus Business

As with any sole proprietorship, it’s important to keep your business expenses separate from your personal expenses for tax purposes. For example, client lunches can be tax deductible whereas paying for a kid birthday present is not.

See www.irs.gov/publications/p535 with the title Publication 535, Business Expenses.

Tax issues are complex and could change over time. As such, it’s advisable to always consult a tax professional prior to filing your taxes.

What are the advantages of using Express Cash Flow for Commission Advances:

Since 2015, Express Cash Flow has helped real estate agents and brokers in California balance their cash flow between closings. Express Cash Flow can pay you now on a pending transaction to help you grow your business with a commission advance.

- Low rates

- Experienced and trusted partner

- Advance up to 75% of your net commissions

- No credit checks

- Real-time processing

- Personalized Experience

- Multiple advances at one time

Get to the Application Page to receive a commission advance on unearned sales commission today. Express Cash Flow offers Commission Advances for real estate agents and brokers nationwide.

How can I get an advance on unearned sales commission?

Unearned sales commission can be paid out on transactions under contract and on active listings. Funding can take as short as 1 hour and can be funded via wire, Zelle or Venmo.