We have worked in the world of advanced commission for a long time, which means we have seen things change in a lot of different ways over the years. Every time a major shift happens in the financial market, it immediately follows that things change in the world of escrow accounts as well. We track these shifts pretty closely as it is directly connected to advanced commission. The following is a list of some of the changes we have seen with the current market conditions.

Longer Escrow Wait Times

The financial market is improving, which is a good thing, but many different big institutions are now making it a little harder for people to get the financing they need. This is a good thing, as a little caution now can help prevent another big meltdown like the one that happened back in 2008. That being said, the advanced investigations create a longer escrow time. The money sits longer before being distributed to the deserving parties.

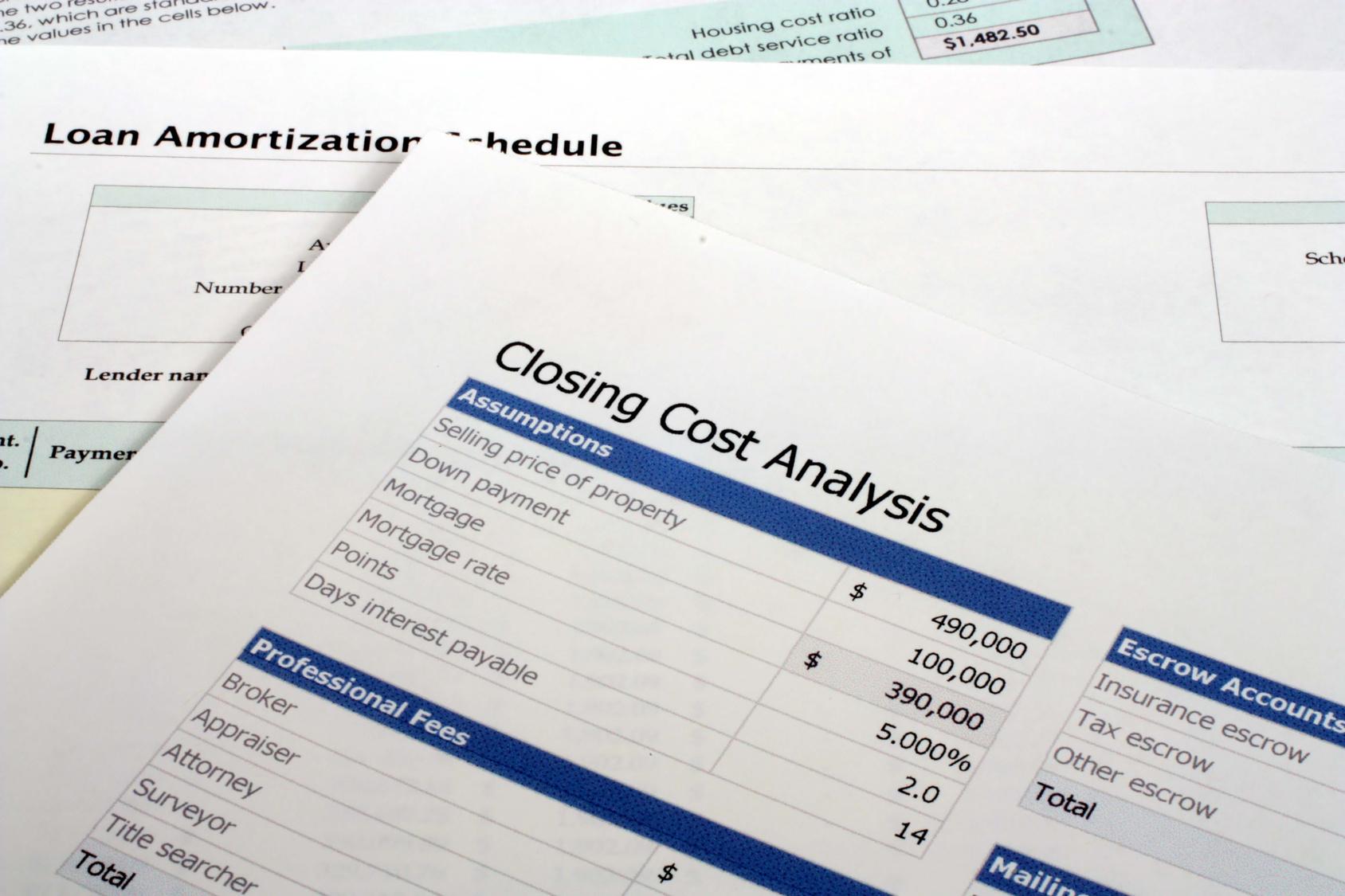

Larger Escrow Accounts

There are fewer loans happening, but we have noticed that these loans are growing in size. The larger loans mean larger down payments and earnest money amounts. All of that is the money that typically sits in escrow accounts. This means that the escrow accounts we deal with are larger in nature due to the growth in the economic market.

More Restrictions on Accounts

This goes back to the tighter restrictions happening with loans. Banking institutions cannot afford to be lax about the security of the accounts under their stewardship. This has affected the world of escrow by making it so fewer people have access to these accounts, and fewer loans are able to utilize an escrow service. This is especially true in the case of new construction loans. We believe that as the market continues to improve, this particular change will not be as stark a difference as it is right now.