You do NOT have to pay taxes on a Commission Advance. Commission Advance fees are tax deductible if the proceeds are used or business purposes.

Commission Advance Fees are Tax Deductible

If commission advance proceeds are used for business purposes, they are considered a tax-deductible business expense. The commission advance fees are similar to interest costs on a loan. Agents and brokers should include an itemized summary with their tax return detailing all advance fees paid to any commission advance service provider they used in the year. If you use Express Cash Flow for your commission advance provider, we will always provide you a statement of all advances taken in a given year or years within 24 hours.

As an independent contractor, owner of an LLC or Corporation, the fees you pay to secure a commission advance are a fully deductible business expense. It’s a true cost of doing business. For sole proprietors, this means recording the fees as a business expense on Schedule C of your tax return.

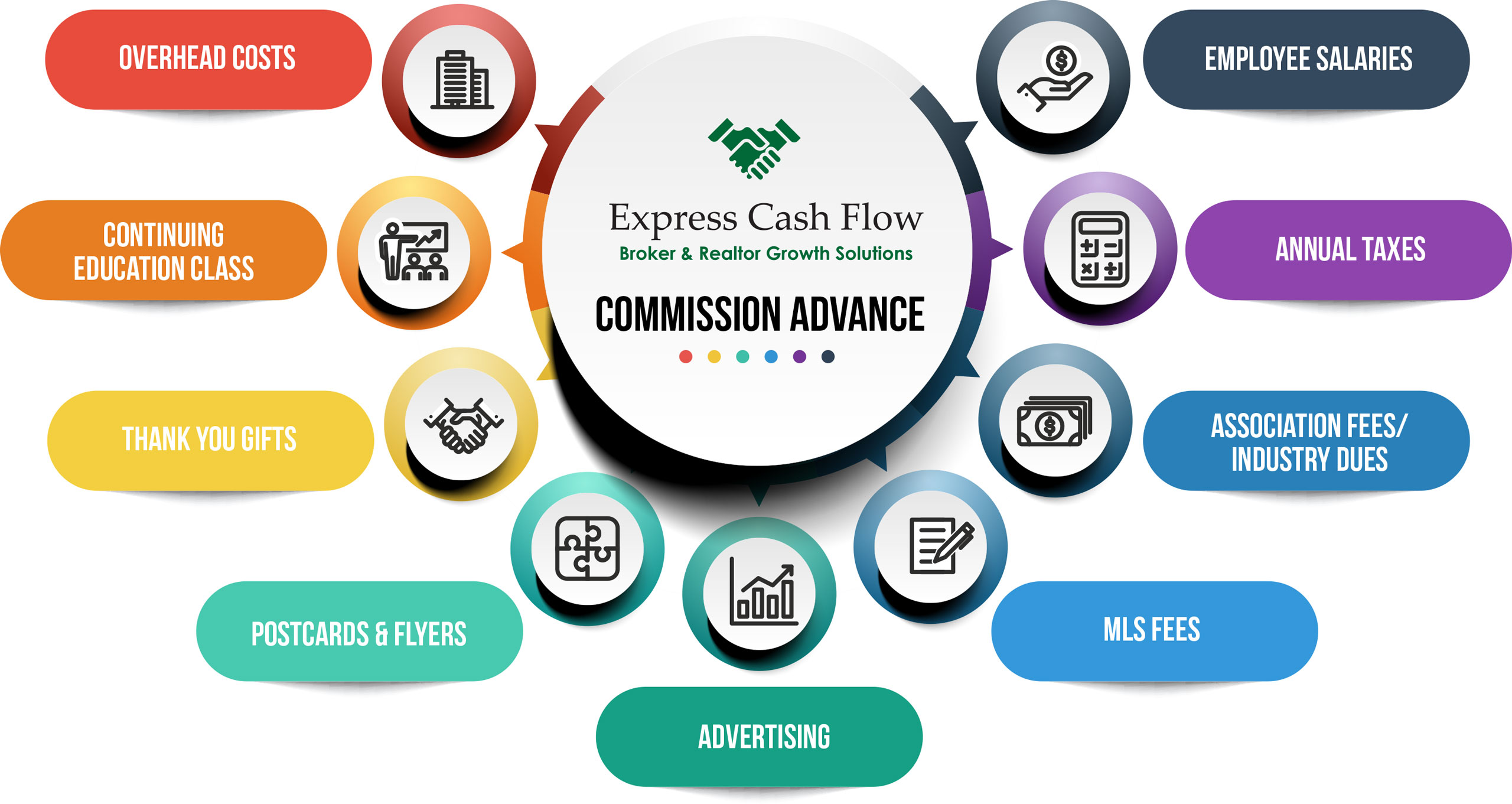

Business Expenses

Further benefits when receiving a commission advance is the fact that business expenses paid for with your advance proceeds are also tax deductible. For example, say you use a portion of your commission advance to pay for office rent. That rent payment is a tax-deductible expense, even though you used your commission advance to make the payment. The same holds true for any other legitimate business expense, such as purchasing marketing materials, car related expenses and meals.

What are the advantages of using Express Cash Flow for Real Estate Commission Advances:

Since 2015, Express Cash Flow has helped real estate agents and brokers balance their cash flow between closings. Express Cash Flow can pay you now on a pending transaction to help you grow your business.

- Low rates

- Experienced and trusted partner

- Advance up to 75% of your net commissions

- No credit checks

- Real-time processing

- Personalized Experience

- Multiple advances at one time

Please visit Application page to get your commission before closing.