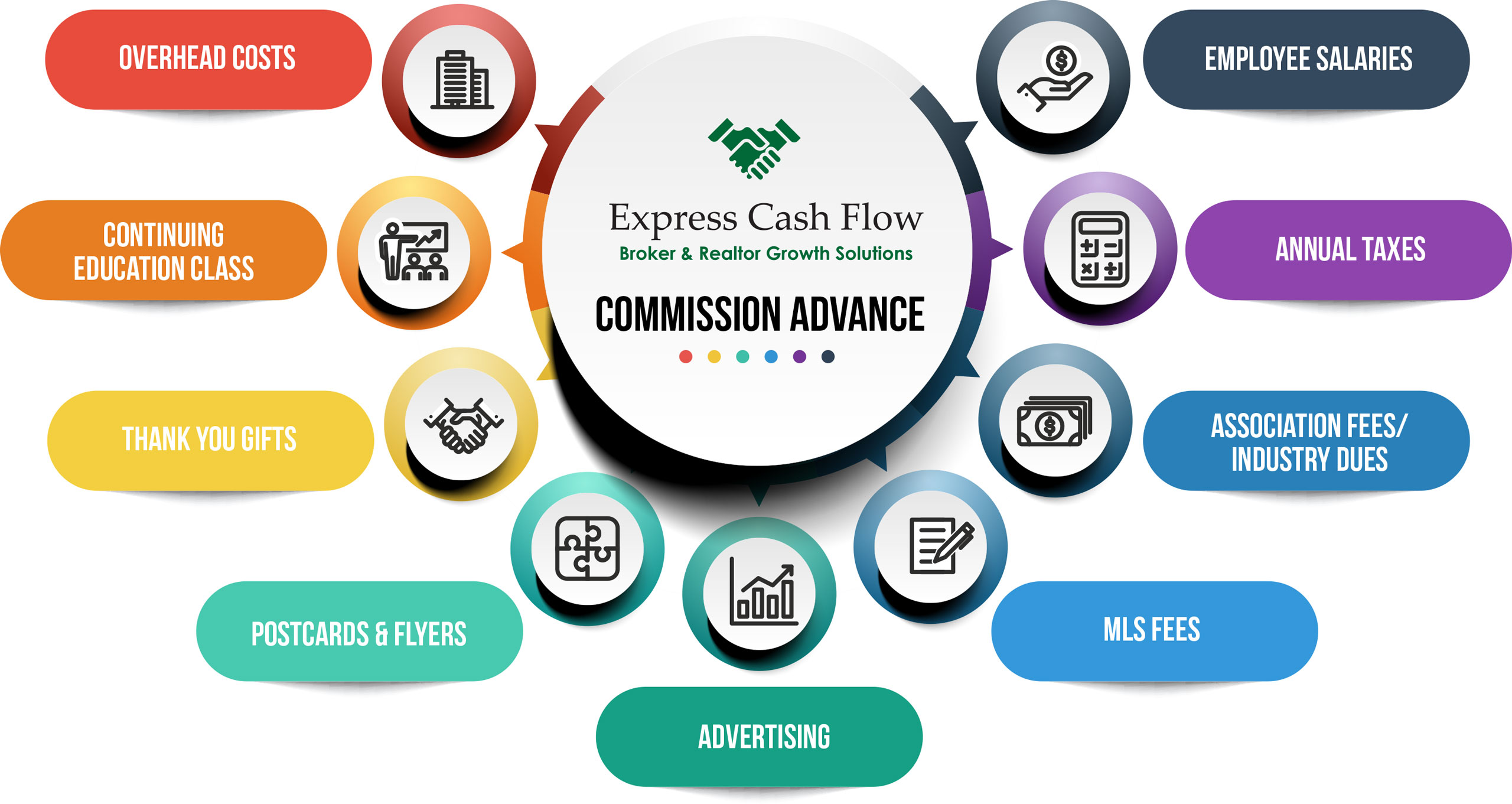

If you’re asking yourself if you should get a commission advance and your bank account is low, then you probably need to get a commission advance. Advances can be used for business purposes such as expanding your marketing budget, promotional materials, car expenses, staging and other related real estate activity.

Can you get a commission advance if you are a buyer’s agent?

As a buyer’s agent, you can get a commission advance. The transaction isn’t as strong as a listing agent’s transaction, but Express Cash Flow can still advance on it.

Do I pay Taxes on a Commission Advance?

You do NOT have to pay taxes on a Commission Advance. Commission Advance fees are tax deductible if the proceeds are used or business purposes.

Commission Advance Fees are Tax Deductible

If commission advance proceeds are used for business purposes, they are considered a tax-deductible business expense. The commission advance fees are similar to interest costs on a loan. Agents and brokers should include an itemized summary with their tax return detailing all advance fees paid to any commission advance service provider they used in the year. If you use Express Cash Flow for your commission advance provider, we will always provide you a statement of all advances taken in a given year or years within 24 hours.

As an independent contractor, owner of an LLC or Corporation, the fees you pay to secure a commission advance are a fully deductible business expense. It’s a true cost of doing business. For sole proprietors, this means recording the fees as a business expense on Schedule C of your tax return.

Business Expenses

Further benefits when receiving a commission advance is the fact that business expenses paid for with your advance proceeds are also tax deductible. For example, say you use a portion of your commission advance to pay for office rent. That rent payment is a tax-deductible expense, even though you used your commission advance to make the payment. The same holds true for any other legitimate business expense, such as purchasing marketing materials, car related expenses and meals.

What are the advantages of using Express Cash Flow for Real Estate Commission Advances:

Since 2015, Express Cash Flow has helped real estate agents and brokers balance their cash flow between closings. Express Cash Flow can pay you now on a pending transaction to help you grow your business.

- Low rates

- Experienced and trusted partner

- Advance up to 75% of your net commissions

- No credit checks

- Real-time processing

- Personalized Experience

- Multiple advances at one time

Please visit Application page to get your commission before closing.

Are commission advance fees tax deductible?

Are commission fees tax deductible? The answer is yes if your commission advance proceeds are used for your business expenses, the costs are tax deductible. You may opt to use Express Cash Flow on every transaction or just when there are more bills than commission.

Commission Advance Fee Tax Deductibility

Because commission advances are used for business purposes, they are considered a tax-deductible business expense. The commission advance fees are similar to interest costs on a loan. Agents and brokers should include an itemized summary with their tax return detailing all advance fees paid to any commission advance service provider they used in the year.

As an independent contractor, owner of an LLC or Corporation, the fees you pay to secure a commission advance are a fully deductible business expense. It’s a true cost of doing business. For sole proprietors, this means recording the fees as a business expense on Schedule C of your tax return.

Business Expenses

Further benefits when receiving a commission advance is the fact that business expenses paid for with your advance proceeds are also tax deductible. For example, say you use a portion of your commission advance to pay for office rent. That rent payment is a tax-deductible expense, even though you used your commission advance to make the payment. The same holds true for any other legitimate business expense, such as purchasing marketing materials, car related expenses and meals.

Personal versus Business

As with any sole proprietorship, it’s important to keep your business expenses separate from your personal expenses for tax purposes. For example, client lunches can be tax deductible whereas paying for a kid birthday present is not.

See www.irs.gov/publications/p535 with the title Publication 535, Business Expenses.

Tax issues are complex and could change over time. As such, it’s advisable to always consult a tax professional prior to filing your taxes.

What are the advantages of using Express Cash Flow for Commission Advances:

Since 2015, Express Cash Flow has helped real estate agents and brokers in California balance their cash flow between closings. Express Cash Flow can pay you now on a pending transaction to help you grow your business with a commission advance.

- Low rates

- Experienced and trusted partner

- Advance up to 75% of your net commissions

- No credit checks

- Real-time processing

- Personalized Experience

- Multiple advances at one time

Get to the Application Page to receive a commission advance on unearned sales commission today. Express Cash Flow offers Commission Advances for real estate agents and brokers nationwide.

How can I get an advance on unearned sales commission?

Unearned sales commission can be paid out on transactions under contract and on active listings. Funding can take as short as 1 hour and can be funded via wire, Zelle or Venmo.

eXp Realty Agents Build Wealth Through Multiple Levers Including Commission, Revenue Share, and Stock Offerings in 2021

eXp Realty has been focused on innovating and supporting agents in a virtual world since the very beginning. That’s why the brokerage has built its foundation on a state-of-the-art online platform to eliminate the traditional brick-and-mortar offices in favor of a cloud-based brokerage. That way, eXp can offer agents equal opportunity to build true wealth through virtually limitless earning potential. Every other real estate broker out there allows you to build one single income stream that comes from trading your time for money. Therefore, as soon as you stop showing properties all day long or stop picking up the phone late at night, you will stop receiving income. With eXp, you have most advantageous capped commission structure to build a successful real estate career then add in a passive income stream through revenue sharing program and become shareholders at eXp Realty in a variety of ways.

In this article, we will cover the following:

- eXp Commission – Equal Opportunity

- Transaction Fees

- Revenue Share

- eXp Stock Ownership

- Other Fees

- ICON program

eXp Realty Commission: Every Agent Has the Same Commission Structure at eXp

Unlike traditional brokerages where commissions are variable and often depend on an agent’s negotiating skills, production or relationships, all agents at eXp get the same commission structure: 80/20 with a $16,000 cap. Team members are eligible for one-half to a one-quarter cap, based on team performance.

That means agents at eXp keep 80% of the commission earned until they have paid a total of $16,000. After that, the agent keeps the entire commission (100%) for the duration of their anniversary year. There are no franchise or royalty fees charged at eXp Realty.

Transactional fees, charged only for closed sales, cover the broker review ($25) and risk management fee ($40) together capped at $500 per year.

See examples below for how commissions and costs break down.

The risk management fee caps at $500 and then goes to $0. The capped transaction fee reduces to $75 per transaction after $5,000 has been paid.

Example 1: Commission and fees for a $350,000 closing with 3% commission for an agent who has not reached the $16,000 cap:

Gross Commission = $10,500

- Deduct eXp Company Dollar = $2,100 (20%)

- Deduct Broker/Risk Fees = $65

Agent Net Commission = $8,335

Example 2: Commission and fees for a $350,000 closing with 3% commission for an agent who has reached the $16,000 cap:

Gross Commission = $10,500

- Deduct eXp Company Dollar = $0

- Deduct Capped Transaction Fee = $250

- Deduct Broker/Risk Fees = $65

Agent Net Commission = $10,185

eXp Realty Transaction Fees

After a real estate agent caps, they go to 100 percent and only pay $250 per transaction. If an agent pays in $5,000 in transaction fees after capping, they will move to a $75 per transaction fee for the remainder of the anniversary year.

For example, let’s say you sell 60 homes in one year with an average commission amount of $6,000 per transaction. Here is how your eXp Realty commission split would work out:

- Transactions 1-14 would be on an 80/20 split with NO transaction fee.

- Transactions 15-34 would be on a 100/0 split with a $250 transaction fee.

Transactions 35-60 would be on a 100/0 split with a $75 transaction fee.

To explain, you would cap on your 14th transaction ($6,000 x 14 transactions = $84,000). Transactions 15-34 would all be at $250/per transaction totaling $5,000. Transactions 35-60 would be at $75 per transaction.

eXp Revenue Share: Agents Earn Revenue Share Through Sponsored Agents

Perhaps one of the most exciting, yet misunderstood benefits at eXp is revenue share. The revenue share opportunity is simply when an agent joins eXp and names an active eXp agent as their “sponsor.” The sponsor is the eXp agent who was most influential in the new agent’s decision to join eXp.

Once the new agent begins closing on transactions, the sponsor receives a percentage of the company dollar (revenue) from the sales activity of their sponsored agent. It is based on gross commission income (GCI), and is dynamically calculated and paid monthly.

This is a different concept than profit-sharing, in which certain brokerages share company profits with agents after all expenses have been subtracted from revenue. That includes costs such as rent, insurance, utilities, staff salaries, and other costly overhead charges. In a profit-share model, it often happens that a sponsored agent is productive but the office or franchise is not profitable, resulting in minimal or zero profit-share.

eXp Stock: eXp Agents Can Acquire Stock in a Variety of Ways

The third unique form of compensation for agents at eXp is becoming a shareholder with the company. eXp Realty agents are awarded or can earn shares of stock in eXp World Holdings (eXp Realty’s parent company) after certain milestones are reached, including:

- Closing on the first transaction as an eXp Realty agent ($200 stock award)

- The first closed transaction by any agent they have sponsored ($400 stock award)

- Reaching the annual cap ($400 stock award)

- Reaching ICON Agent status ($16,000 stock award)

- Agents can also elect to receive up to 5% of their commissions from each closed sale in the form of eXp stock at a 10% discount through the Agent Equity Program.

Other eXp Fees

eXp Realty fees consist of monthly and transaction fees. I’ll cover each in more detail below.

eXp Realty does not charge a desk fee, royalty fee, or franchise fee. Also, there are no minimum production or attraction requirements. So long as you stay current on your $85 monthly fee and all state licensing requirements you can remain licensed at eXp Realty.

Risk Management Fee (Errors & Omissions)

Many agents are familiar with the term errors and omissions. At eXp Realty, we call this the risk management fee. The risk management fee varies by country, but in the US, it is $40 per transaction.

Once a real estate agent hits $500 in risk management fees paid for the year, the agent will no longer pay risk management fees for the remainder of the anniversary year.

Broker Review Fee

All US agents pay a $25 per transaction broker review fee.

This fee does not cap.

eXp Realty Mentor Fees

Agents who’ve completed less than three transactions in their current market will be enrolled in the eXp Realty’s mentor program. Agents in the mentor program are assigned a certified mentor who will help assist with the agent’s first three transactions at eXp Realty.

Mentees pay an additional 20 percent split on these first three transactions which pays the mentor and mentor program (which consists of additional training modules for the mentee).

Once the mentee closes three transactions with eXp Realty, they graduate from the mentor program and are not subject to the additional 20 percent commission split.

eXp Realty Seller Fees

eXp Realty does not charge any additional fees to clients. Agents can determine their commission rate and any additional fees to their clients. However, whatever rate and fees that are charged to the client are then split with eXp Realty at the typical commission split.

If an agent wishes to discount their commission rate and that agent has not reached their commission cap, the minimum transaction split to eXp Realty is $500. Therefore, an agent can reduce their commission completely to $0 to the client but the agent would then be responsible to pay eXp Realty $500 for that transaction, plus the broker review and risk management fee.

eXp Realty Personal Deals

At eXp Realty, agents can complete three personal transactions per year without paying the 20 percent split to eXp Realty.

Agents are only responsible to pay a $250 transaction fee, $40 risk management fee, and $25 broker review fee for the personal deal.

A personal transaction consists of only the deals for which the eXp Realty agent is personally on the contract.

Commission Split and Fees Example on 60 Transaction for the Year

Their total eXp Realty Commission Split paid for the year would equal:

- $16,000 – Cap

- $5,000 – $250 Transaction Fees

- $1,875 – $75 Transaction Fees

- $500 – Risk Management Fees

- $1,500 – Broker Review Fees

- $24,875 – Total eXp Realty Commission Split Fees

How would you like to earn $16,000 of those fees back? Read below about the ICON agent program at eXp Realty and see how you can do just that.

$500,000 Annual Gross Commission Income Plus ICON Qualifying Fee

The second way you could qualify to become an ICON agent is by achieving an “Annual gross commission income of $500,000 or more with a minimum of 10 closed transactions and payment of an “ICON Qualifying Fee.” This fee is equal to $5,000 less capped transaction fees paid during the same anniversary year.

The last part of becoming an ICON agent is to” Demonstrate company culture by giving back by teaching a class, serving on a panel, or serving on a committee. Also, an ICON agent must have a willingness to promote eXp Realty within their community.”

That’s it! Once you’ve accomplished the above requirements, you would earn $8,000 in publicly traded eXp World Holdings (EXPI) common stock. This stock vests after three years.

You would acquire an additional $4,000 after one year, once your cultural requirements are fulfilled and verified.

ICON agents earn the last $4,000 in stock awards after attending each of the two annual eXp Realty events .

The company issues $2,000 after each company event (The eXp Shareholder Summit and EXPCON ) with no vesting period, for a possible total of $4,000 from attending the company events.

Wrapping Things Up

In conclusion, the eXp Realty Commission Split is very generous compared to the majority of brokerages out there. Especially when you consider the ICON Agent Program, eXp Realty is genuinely unique. Combine this with all the tools and training that eXp Realty provides to real estate agents, and you get an excellent opportunity to grow your career in real estate.

Do you have any questions related to the eXp Realty Commission Split? Put them in the comments below and I would be happy to answer them! Also visit Express Cash Flow.

What Is A Commission Advance?

Key Takeaways:

- Commission advance is getting the commission before closing

- Commission advance is not a loan

- It is commonly used to bridge the gap between closings

- The price of commission advance varies wildly depending on how companies’ policy

1. Commission Advance definition:

By definition, a commission advance is a financial service whereby you sell a portion of a pending commission for a fee. In exchange, funds are advanced to you before closing. It’s not a loan. It’s simply access to the commission you’ve earned without the wait! Get your commission whenever you want.

2. Win-Win Pricing:

The fine print may vary, but the essence of each is the same. The first step is getting a property under contracts. Once you’ve done that, congrats, you are now potentially eligible for an advance. So let’s consider how the pricing works.

The one-size-fits-all model:

Each company has different policy. Many have opted for a simple fixed pricing structure to avoid headaches. The telltale sign is a pricing slider on their website. This has both pros and cons. At first glance, while it seems to provide an easy estimate of how much a commission advance will cost, this one-size-fits-all pricing model leaves no room for negotiation. In fact, top producers can easily enjoy a much lower rates if their productions history is taken into the account. What if a realtor is just having a rough quarter and cannot fit in the pricing model? He/she will be denied immediately.

The Custom Pricing Model:

Every transaction is different, so why have a one-size-fits-all? Custom pricing model use a risk-based pricing plan to review each commission advance request. That means the production history, details of the transaction, and closing dates, as well as other verifications are taken into consideration to create a tailored solution for that one advance. The question is: why do a lot of work just for a simple advance? It’s simple: once you look deeper into the case, the underwriter can see the agent as a real estate professional, not just a number in a spreadsheet. By adding the human factor to the mix, this model can approve more cases and also lower the rates significantly for top producers. It’s simple, the lower the risk, the better the rates.

Express Cash Flow is one fine example of custom pricing model. Once an application is submitted, ECF proprietary AI Modeling analyzes over 200 attributes to create a custom risk profile for your unique situation. Then, an underwriter will thoroughly assess the case to create a custom pricing model tailored to your needs. Some of the primary attributes to look at are:

- Your production history

- Details of the transaction

- Expected closing date

- Verification & review of all publicly available information

The result is up to 30% reduction in advance fee and a faster processing time since everything is automate in the beginning and the underwriter only need to review the information at the end.

3. Get your money faster!

If you are approved, you’ll be presented with an offer of an advance on your commission. You will receive the commission advance agreement via DocuSign that you and your broker will sign (or by you, if you are your own broker). You will be funded within hours via wire and not ACH. A good commission advance company will be able to fund you the same day. You should expect simple paper work, no credit checks, and most importantly, no massive stack of loan documents to sign. At Express Cash Flow, the entire process from Application to Funding can take place within 4 hours. There are no partial holdbacks like some other companies.

4. Paying back the advance:

Technically, when you get funded, everything is taken care for you. The advance is automatically paid back when the escrow or settlement company closes. The amount is equal to the advance plus the fee. That means you never pay anything out of pocket. You get the much-needed liquidity to grow your business and thrive.

5. What if escrow falls out?

It is nothing to worry about. While doing market research for commission advance, we found out most companies are smart enough to give the advance to those who are likely to close the deal. After all, advance companies want to make money and avoid any foreseeable risk. At Express Cash Flow, after more than $3 billion property worth of advance, we have a 99.5% closing rate of all advances. Our AI underwriting model optimize the process and reduces the risk of deals falling through. Even if the deal falls, you can simply switch your advance to another escrow for a minimal fee (no hefty penalties or immediate payback requirements).

6. How much of my commission can I advance?

You can advance up to 75% of your *net* commission. Your net commission is determined by calculating the total gross commission, and then removing the portion due your broker, plus any office, TC, franchise or referral fees, i.e. the money that would be going into your pocket. So if you have a $500K transaction with a 2.5% commission and are on an 80/20 split, your gross commission would be $500K*2.5% or $12,500. Your net commission would be $12,500*80% or $10,000, and we would be able to advance 75% of that ($7,500). You can take less than this if you’d like, but $7,500 would be the maximum advance amount

7. Is there a minimum advance amount and a minimum fee?

Yes. Statutory guidelines dictate that the minimum advance amount is $2,500, so you’ll need to be earning a net commission of at least $3,000 in order to qualify for an advance. The minimum fee, which usually applies on advances of up to $5,000 for less than 30 days, is $400. Please note that this for every outgoing wire, so if you want $5,000 for 25 days or $2,500 for 2 days, the fee will still be $400. Proper planning can help you get the most efficiency out of our fee structure.

Summary of Benefits of Using Express Cash Flow:

- Get to 75% of your commission on the same day

- No credit checks

- No out of pocket charge

- No hold-backs, no hidden fee

- Agent friendly pricing

- Personalized service

We know you don’t all need a commission advance, but we could all use a little extra cash every now and then, and we hope you think of Express Cash Flow whenever the need arises.

Apply for commission advance today.

Top Zillow Profile Optimizing Tricks

A Zillow profile is the cornerstone for lead generation which helps convert prospects to contracts. Placing your profile in the right location is key…marketing costs differ by zip code. While 75% of a real estate agent’s business comes referrals and word of mouth, you still need a solid Zillow profile.

1. Start with a Professional Photo that Matches all your Other On-Line Profiles

Start with the photo. Use a high-quality head shot. Avoid logos, yard signs and team pictures. A clear, individual headshot seems to work best.

2. Introduction and About Us

Add your experience, specialties and skills. This should include your geographic area of focus, and any particular specialty you have, like short sales, REOs, probate or buyer representation. Also include your team and their profiles.

3. Add Your Listings and Past Sales

This is usually done automatically but you can manually add your listings if you have recently switched to a different MLS. You’ll want to highlight all of your best transactions, even if they didn’t occur on the MLS.

4. Professional Information

Have a complete and updated profile of your office address, cell phone, brokerage name, social media websites and our real estate license information. Add a Facebook, LinkedIn, Twitter, Website and for the Blog us Instagram. Make sure the links work after you have completed your profile.

5. Update your other social media profiles for consistency

Have the same profile picture, brokerage and links that work.

6. Include an intro video

Prospective buyers and sellers want to get to know you in a 30-60 second video. Who are you and what are you going go to do for them. Why are you better than other agents? Also market this video on Facebook, LinkedIn and Instagram.

7. Ratings and Reviews – Get 5 Stars

This is huge! You’ll want to ask past clients to review your skills for Local Knowledge, Process Expertise, Responsiveness, and Negation Skills along with adding some commentary. Respond to every review — positive, negative or neutral. You’ll look professional and focused on customer service (stay positive!) fora complete Zillow Profile.

8. Add other Members of your team to your profile.

If you have a team add their full profile to yours, and make sure to add the properties they sell to your page to boost your portfolio even further.

9. Become a Zillow Premier Agent

The Zillow Premier Agent program is designed with the simple purpose of bringing agents more buyers, more sellers, and more business. Each service tier is loaded with innovative and powerful features aimed to generate more traffic to your brand and your listings — helping you sell homes faster. To help finance your marketing check out www.ExpressCashFlow.com.

10. Other Real Estate Marketing Ideas

https://www.zillow.com/agent-resources/blog/100-real-estate-marketing-ideas/

Conclusion

Build a complete Zillow profile and be sure to revisit it every few months (set a quarterly reminder on your calendar, or you will forget!) and update as necessary. When you get a lead be very responsive…within 5-10 minutes otherwise the prospect might move on.

This post is brought to you by Express Cash Flow – Helping you grow your real estate business by providing you with cash today.

Hard Pull vs Soft Pull Credit Checks

For many an individual and business, access to credit depends on FICO scores, recent credit checks and the contents of credit history reports maintained at the three major credit bureaus – Equifax, TransUnion and Experian. A “pull” is a credit inquiry from a legitimate entity, made in order to check your credit.

A hard pull is one that can affect your FICO score, whereas a SOFT PULL HAS NO EFFECT. This is important to remember, because too many hard pulls can lower your credit score. The Fair Credit Reporting Acts sets limits on why and when your credit report can be pulled.

Soft Pulls – Credit Checks

All credit inquiries that are not credit checks by a prospective lender are soft pulls. First, any inquiries you make upon your own credit reports or FICO scores are automatically a soft pull credit check, so feel free to make as many as you like.

Other soft-pull examples include:

• Credit inquiries from businesses that want to offer you goods or services (for example, a promotional offer from a credit card issuer or mortgage lender)

• Inquiries from businesses where you already have established a credit account.

• Pre-approved loan and credit card offers

• Employers and others performing a background check on you. For some reason, employers tend to gravitate towards job candidates with good credit ratings.

You may be subject to a soft pull and not even know it. Often, soft pulls help businesses save money when canvassing for new customers, because these inquiries can rule out some potential prospects, saving the business paper and postage costs.

Hard Pulls – Credit Checks

Hard pulls result when a potential lender wants to review your credit application. Common credit applications that trigger hard pull credit checks are ones for credit cards, mortgages and car loans. Each credit check is counted as one inquiry. However, you get a break if you are “rate shopping,” in that all inquiries for the same purpose, such as a mortgage, business loan, rental property, student loan, etc., within a 45-day period are counted as only a single hard pull. This has implications – if you are apartment hunting, its best to do it within a short period if you want to maintain your FICO score.

Common Soft Inquires:

• Verification of identity

• Unsecured debt

• “Pre-qualified” credit card offers

• “Pre-qualified” insurance quotes

• Car rentals

• Obtaining an Internet or cable account

• Opening a bank account

• Requesting a higher credit limit

• Contracting for a cell phone account

Common Hard Inquiries:

• Mortgage applications

• Auto loan applications

• Credit card applications

• Student loan applications

• Personal loan applications

• Apartment rental applications

Pulls and Scores

Although a hard pull can affect your FICO score, the impact upon your score can vary. The score is sensitive to several factors:

• The inquiry must be a voluntary application for credit

• The number of new accounts you have recently opened

• The percentage of your accounts that have recently been opened, by account type

• The number of recent credit inquiries you have had

• The amount of time that has elapsed since you opened an account, by account type

• The amount of time since the last credit inquiry

The good news is that a single hard pull or credit check might not affect your credit score at all, and even if it does, the cost is usually less than five points. The bad news is that if you have a short credit history or just a handful of credit accounts, a hard pull can have a greater impact on your credit score. So can multiple hard pulls that are not categorized as rate shopping. Wonder why? Here’s the dirty little secret – consumers with at least six credit inquiries are 8X more likely than those with no inquiries to file for bankruptcy.

By the way, you can dispute a hard inquiry performed without your permission. Authorized hard pulls usually hang around on your credit history for a couple of years.

Soft Is Better for a Credit Check

Now, if you are looking for a commercial business loan, keep in mind that Express Cash Flow uses soft credit pulls that won’t affect your credit score. When you combine this with our fast, no-hassle process and quick turn round, it’s easy to see why Express Cash Flow is growing into one of the commission advance companies in the U.S.

Realtors plot statewide database to combat Zillow, Redfin and other apps

Is the Realtor, run property listing service in California obsolete?

Several brokers, agents and “multiple listing service” operators expressed concern during a panel discussion Wednesday that commercial websites like Zillow, Redfin and Realtor.com have overtaken the patchwork of industry databases agents use to find homes for clients.

“The world of big data doesn’t seem to have come to the MLS in any meaningful way,” said David Silver-Westrick, a partner at San Clemente-based Keller Williams OC Coastal Realty. “We’re missing the boat on lots of big data opportunities. To the extent that consumers have better tools than we do, we just become irrelevant.”

The California Association of Realtors sponsored Wednesday’s event, held at CAR headquarters in Los Angeles, to plot the future of broker-run MLS sites and to find ways to meet the association’s 12-year-old goal of forming a single, statewide database in California. There currently are more than 40 MLS’s in California.

Agents use the MLS to disseminate information about homes for sale, providing property details as well as insider information about showings and compensation.

The statewide MLS effort so far has led to the formation of the Diamond Bar-based California Regional Multiple Listing Service, which currently represents most of Southern California and the Bay Area. CRMLS includes more than 92,000 agents and 37 local Realtor associations. But that’s still less than half the local associations in the state and doesn’t include San Francisco, Ventura County and most of Santa Barbara County, according to the MLS’s website.

“I think that there is an opportunity that is fast fading,” said CRMLS CEO Art Carter. “If we do not do it shortly, then we will forever be chasing others that will most likely take the handles and move forward.”

Other panelists lamented MLS problems include inaccurate and outdated data as well as the lack of consolidation.

“As someone who lists and sells real estate, I need it to be more efficient,” said Jeanne Radsick, an agent with Century 21 Tobias Real Estate in Bakersfield. “I need to not have to go to multiple sources to find what I’m looking for.”

Technology isn’t an issue, panelists said. Carter said a statewide MLS could be established in three months once the paperwork is in place.

The main obstacle is politics. Concerns among agents and brokers include the question of who controls broker information — the MLS or the brokers themselves. MLS employees also worry about losing their jobs under a consolidated system. And smaller MLS sites fear larger, out-of-area brokerages will take away their business if the outsiders have access to property data in their areas.

“The politics (is) on the local level with (small) MLS’s. You can’t even get Arrowhead and Big Bear to talk, and they’re right next door to each other,” said Sandra Deering, a broker with Coldwell Banker Residential Brokerage in Newport Beach. “The reality is those people are still protective of their jobs. … They don’t have the bandwidth, I don’t think, to see beyond their day-to-day operation. I don’t know how to overcome that.”

Deering has to join 25 MLS sites for her business, “and just managing the licensing, the payment process is a full-time staff person,” she said.

“These changes in the environment, particularly on the consumer side, have given the consumer … the ability to have information that is equivalent, if not superior, to what the agents have,” said Joel Singer, CEO of the state Realtor association. “The question is can this current structure survive? Or perhaps the question is should this current structure survive if it doesn’t alter.”

Singer said that when he bought a house last year, the MLS data from his broker “didn’t compare very well to the data that I got when I signed up with Redfin. … Is this a problem for us?”

Carter and other panelists see a statewide MLS as a precursor to forming a nation-wide system.

“It’s a process of becoming a lot more aggressive,” Carter said. “Consolidate with the willing and (share data) with the unwilling to consolidate and go around those that are just willing to do neither.”

Source: Redfin California