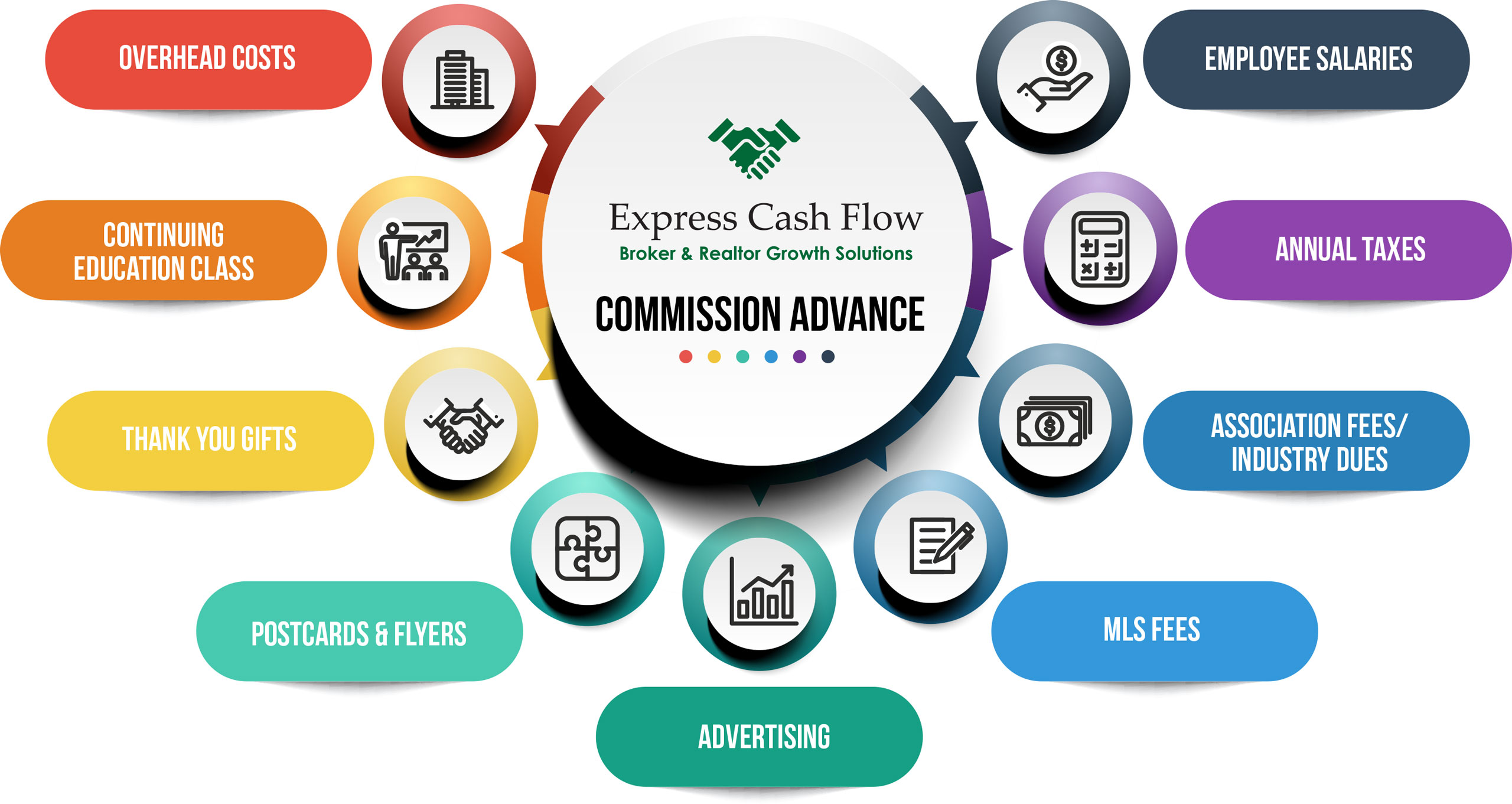

If you’re asking yourself if you should get a commission advance and your bank account is low, then you probably need to get a commission advance. Advances can be used for business purposes such as expanding your marketing budget, promotional materials, car expenses, staging and other related real estate activity.

Can you get a commission advance if you are a buyer’s agent?

As a buyer’s agent, you can get a commission advance. The transaction isn’t as strong as a listing agent’s transaction, but Express Cash Flow can still advance on it.

Do I pay Taxes on a Commission Advance?

You do NOT have to pay taxes on a Commission Advance. Commission Advance fees are tax deductible if the proceeds are used or business purposes.

Commission Advance Fees are Tax Deductible

If commission advance proceeds are used for business purposes, they are considered a tax-deductible business expense. The commission advance fees are similar to interest costs on a loan. Agents and brokers should include an itemized summary with their tax return detailing all advance fees paid to any commission advance service provider they used in the year. If you use Express Cash Flow for your commission advance provider, we will always provide you a statement of all advances taken in a given year or years within 24 hours.

As an independent contractor, owner of an LLC or Corporation, the fees you pay to secure a commission advance are a fully deductible business expense. It’s a true cost of doing business. For sole proprietors, this means recording the fees as a business expense on Schedule C of your tax return.

Business Expenses

Further benefits when receiving a commission advance is the fact that business expenses paid for with your advance proceeds are also tax deductible. For example, say you use a portion of your commission advance to pay for office rent. That rent payment is a tax-deductible expense, even though you used your commission advance to make the payment. The same holds true for any other legitimate business expense, such as purchasing marketing materials, car related expenses and meals.

What are the advantages of using Express Cash Flow for Real Estate Commission Advances:

Since 2015, Express Cash Flow has helped real estate agents and brokers balance their cash flow between closings. Express Cash Flow can pay you now on a pending transaction to help you grow your business.

- Low rates

- Experienced and trusted partner

- Advance up to 75% of your net commissions

- No credit checks

- Real-time processing

- Personalized Experience

- Multiple advances at one time

Please visit Application page to get your commission before closing.

Do Brokers have to sign Commission Advances?

A common question commission advance companies get is “Do Brokers have to sign Commission Advances?”. The answer is yes because legally under the contract the Broker is owned the commission. You and the broker have a separate agreement outlining your split.

Express Cash Flow offers the Best Commission Advances

Express Cash Flow offers the best Commission Advances nationwide. Agent and broker real estate commission advances can be used for business purposes such as expanding your marketing budget, promotional materials, car expenses, staging and other related real estate activity.

Are commission advance fees tax deductible?

Are commission fees tax deductible? The answer is yes if your commission advance proceeds are used for your business expenses, the costs are tax deductible. You may opt to use Express Cash Flow on every transaction or just when there are more bills than commission.

Commission Advance Fee Tax Deductibility

Because commission advances are used for business purposes, they are considered a tax-deductible business expense. The commission advance fees are similar to interest costs on a loan. Agents and brokers should include an itemized summary with their tax return detailing all advance fees paid to any commission advance service provider they used in the year.

As an independent contractor, owner of an LLC or Corporation, the fees you pay to secure a commission advance are a fully deductible business expense. It’s a true cost of doing business. For sole proprietors, this means recording the fees as a business expense on Schedule C of your tax return.

Business Expenses

Further benefits when receiving a commission advance is the fact that business expenses paid for with your advance proceeds are also tax deductible. For example, say you use a portion of your commission advance to pay for office rent. That rent payment is a tax-deductible expense, even though you used your commission advance to make the payment. The same holds true for any other legitimate business expense, such as purchasing marketing materials, car related expenses and meals.

Personal versus Business

As with any sole proprietorship, it’s important to keep your business expenses separate from your personal expenses for tax purposes. For example, client lunches can be tax deductible whereas paying for a kid birthday present is not.

See www.irs.gov/publications/p535 with the title Publication 535, Business Expenses.

Tax issues are complex and could change over time. As such, it’s advisable to always consult a tax professional prior to filing your taxes.

What are the advantages of using Express Cash Flow for Commission Advances:

Since 2015, Express Cash Flow has helped real estate agents and brokers in California balance their cash flow between closings. Express Cash Flow can pay you now on a pending transaction to help you grow your business with a commission advance.

- Low rates

- Experienced and trusted partner

- Advance up to 75% of your net commissions

- No credit checks

- Real-time processing

- Personalized Experience

- Multiple advances at one time

Get to the Application Page to receive a commission advance on unearned sales commission today. Express Cash Flow offers Commission Advances for real estate agents and brokers nationwide.

How can I get an advance on unearned sales commission?

Unearned sales commission can be paid out on transactions under contract and on active listings. Funding can take as short as 1 hour and can be funded via wire, Zelle or Venmo.

Facebook Advertising Guide for Real Estate Agent

For many real estate agents, creating real estate FB/IG ads and generate leads for a reasonable price seems to be a distance dream. Many tried out for a few months then didn’t get the results they want and promptly quit. It’s quite unfortunate but many seems to jump in too fast and never took the time to learn the basics. That’s why we created this guide for real estate agents as a starting point to get you understand how can Facebook help your real estate business.

- How can Facebook help your business?

- Current State of Facebook

- Facebook and Marketing

- How does it work for Real Estate Agents?

- How to do it from scratch

- Create a Facebook personal page

- Create Facebook Business Manager Account

- Create Facebook Business Page

- Create Facebook Ad Manager

- Create and Install Facebook Pixel

- Create your ads

- Test – test – test

- Closing Thoughts

A – What is Facebook Marketing and how can Facebook help Real Estate Agents?

One may say: “I’ve heard FB ads needs lots of money and only work with big companies!?”

It’s true that multibillion-dollar companies set aside enormous budget to advertise on Facebook, but you don’t need to do the same to be successful.

Fear not. There are strategies to make it work for small businesses, especially real estate agents. There is so much you can do on Facebook to help grow your real estate business to the next level. In this mini course, you will learn the most important framework to get started with your Facebook advertising and start generating leads effectively.

A-1 Current State of Facebook

Before we dive headfirst to the unknown water, let’s learn a few things about Facebook and Marketing. (You heard it right, 2 things: Facebook platform and Marketing)

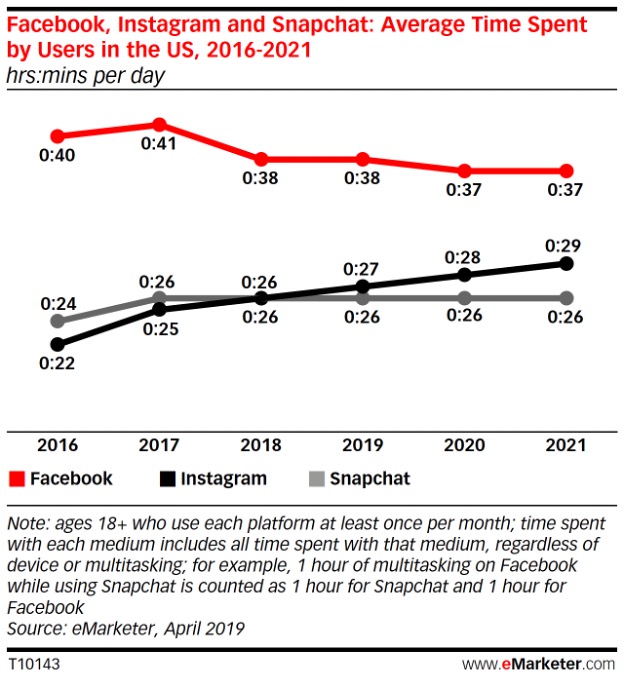

According to Facebook Data report in 2018, more than 2 Billion people around the world are using Facebook every day and 223 Million of them are active users in the United States1 . Latest statistics from eMarketer shows that people in the US spend an average of 37 mins on Facebook and an additional extra 29 mins on Instagram2.

Facebook is truly everywhere. It not only connects people together but also connect people with their favorite businesses and organizations. Because FB have such a wide reach, Realtors can leverage the platform to get in touch with existing and new clients easily.

A-2 Real Estate Agent: Facebook / Instagram and Marketing

Facebook does not and will not replace your traditional marketing efforts. However, it’s a perfect addition to your existing marketing strategies.

You must have heard about the principles of marketing: the 4 Ps (Products, Price, Place, Promotion), and its modern sibling the 4+1Ps (Products, Price, Place, Promotion, and People).

I assume you already know everything about those basic principle. If not, I highly recommend that you spend some time go back to the basic to learn the traditional marketing methods because all principles apply to online marketing.

So, which P do you think Facebook Ads fall into?

It’s a bit easy, isn’t it? If you answer is Promotion. Congratulation. You’ve joined 90% of people who have missed the 5th P – People – YOU. People here refer to the real estate agents, broker, their staffs or anyone who work for the business. It’s basically how you want you yourself to be perceived by your prospects & clients.

How does that translate into the real-world scenario to promote your listing and yourself? Let’s go over some examples for real estate agents:

One – John is a seller agent and you have a property to sell in Newport Beach, California. What would he do?

- He does all the rituals for the MLS listing, do a little Zillow lead thingy, spend couple thousands dollar buying leads.

- He hires a designer to create a website for the property because MLS listing sucks anyway (low resolution pictures, horrible layout, …)

- He sends out flyers, brochures with killer photography to prospects, inviting them to check out the property on the newly created website.

- He sends out emails to prospects

- He holds open houses regularly

- Sponsor local events to promote the house,

- etc. etc. (all the things that top producers usually do)

What if he can do even more using Facebook ads?

- Using Facebook Pixel, a tiny code embedded on the website, he can track how many people have visited the site and serve ads to those who spend time checking out the photos and the 3D tour.

- He can track and serve ads to people who walk into the open house using geo-location fencing technique.

- He can serve ads to specific leads in list he purchased by uploading the list to Facebook.

- He can generate the leads himself by running ads instead of buying leads from Zillow and others.

Two – Jenna is a new agent, and she wants to farm Huntington Beach, California.

- She walks around the neighborhood to greet homeowners as they do their exercise routine.

- She does door knocking and leave informational door hangers

- She sends out mail and postcards with useful information

- She asked to host open houses for other agents who’re too busy to do so she gets to know more about the area. (yes, she saturated the area with her signs instead of the listing agent and the neighbor knows her name)

- She builds the connections within the community

- She hosts local events

- She builds her own website and starts to blog about the best places to visit in the farming area

- She collects email and send out newsletter to collect leads.

What can Jenna do more by running ads on Facebook?

- Drive more traffic to her blog and websites.

- Promote her local events

- Install Google Analytics and Facebook Pixels to track people behaviors on her website then serve ads accordingly

- Setup campaign to send out ads to download the latest local guide to specific zip codes.

In those 2 examples, we can see one thing in common: successful agents rely on multiple channels to deliver their messages and Facebook is just one of them. The platform helps you expand your reach and target only the area that you want.

There are endless possibilities for you to do online marketing in general and FB ads to be specific. The limit is your own creativity. The cost, depending on how big of your area, can be easily justified by the results.

B – How to do Real Estate Agent Facebook ads from scratch

Before you can run ads, you will need to complete several tasks in the following order:

- Create a Facebook personal page

- Create Facebook Business Manager Account

- Create Facebook Business Page

- Create Facebook Ad Manager

- Create and Install Facebook Pixel

- Create your ads

- Test – test – test

B-1 Create Facebook personal page if you don’t have it.

To do advertising on Facebook, you must have a Facebook account; there’s no way getting around that. There are 2 types of Facebook page: personal page and business page. Personal page is used for anything personal, in this page you represent your true self and you’re just like billions of other people: consumer of FB content. Business page, on the other hand, is quite different. It helps people connect to your business and find out more about you as a realtor.

A Business Page is controlled by a personal page or a Business Manager Account. If you don’t have a Facebook personal account for some reasons, please head onto Facebook.com and create one. You can fill in fake personal information (like birthdate and such) if you so ever afraid that FB will steal all of your info. This is your personal Facebook page, so do whatever you think is appropriate with it.

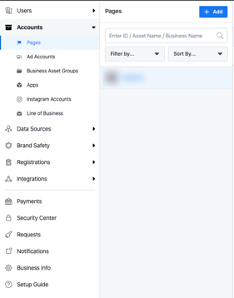

B-2 Setting up Business Manager Account

The next step is to create a Business Manager Account. Through this platform, you can access your business page, Ads manager, and grant access to different people to manage the account. Setting this up is an easy task:

- Go to: business.facebook.com

- Click on “Create Account” on the top right-hand corner.

- If you’re already signed in on Facebook, it will ask you to enter the name of the business, your name, and email address. The process is very straightforward, so you should not have any issue at all.

B-3 Create your Facebook Business Page:

Inside your Business Manager Account, locate the Navigation bar on the left Column.

Click on the Accounts section to expand it

Click on Pages and select Add.

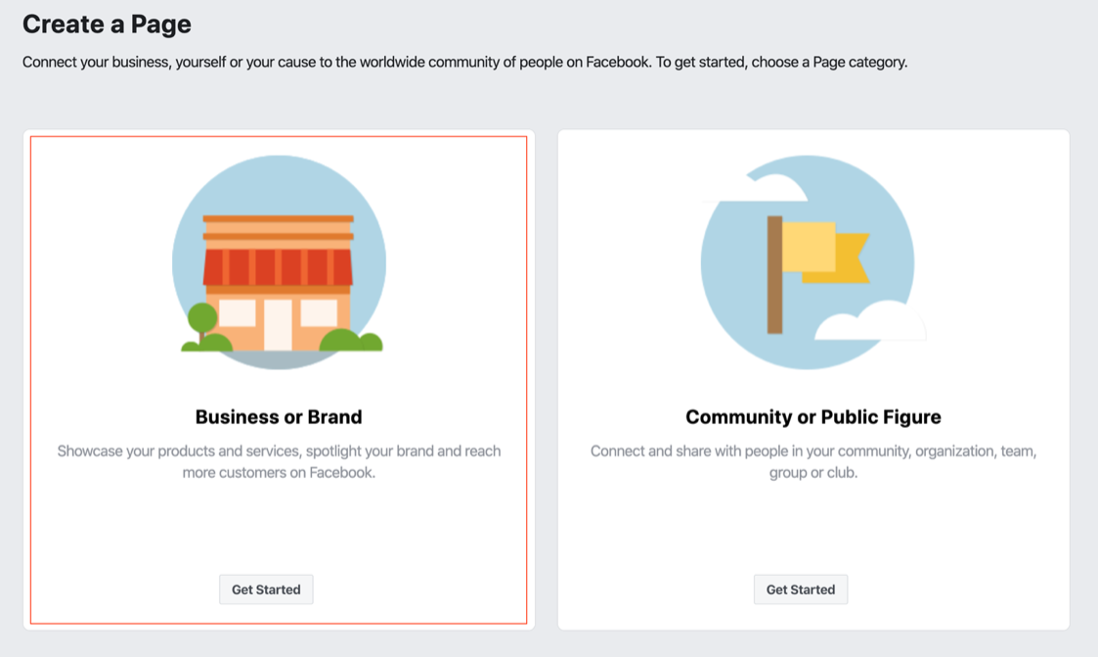

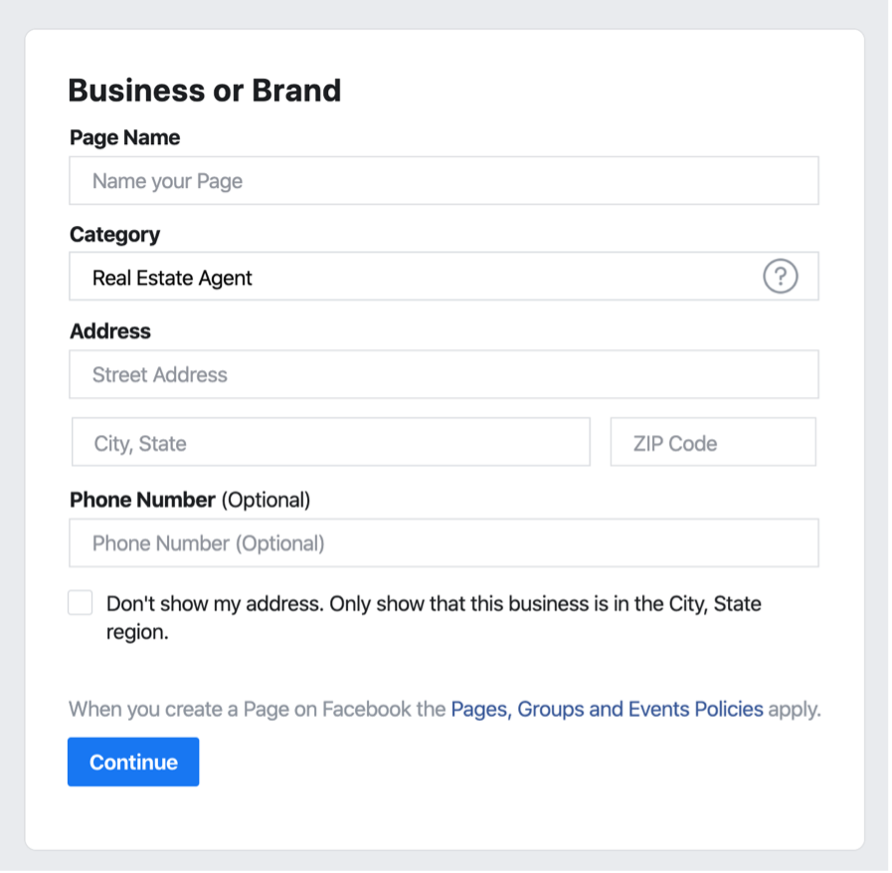

You then select “Business or Brand” option:

Give your page a name and select Real Estate Agent as the Category, then fill in your business information. Leave the check box unchecked. You want people to know your office location, don’t you? Then hit continue.

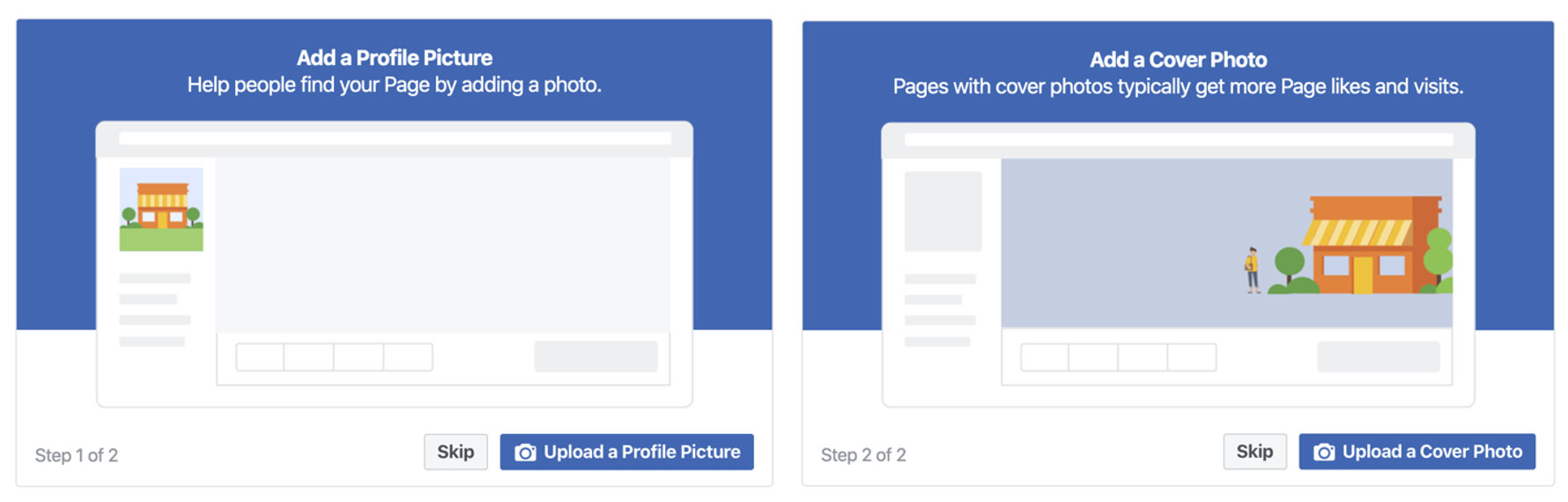

The next step requires you to upload your Profile Photo and a Cover Photo.

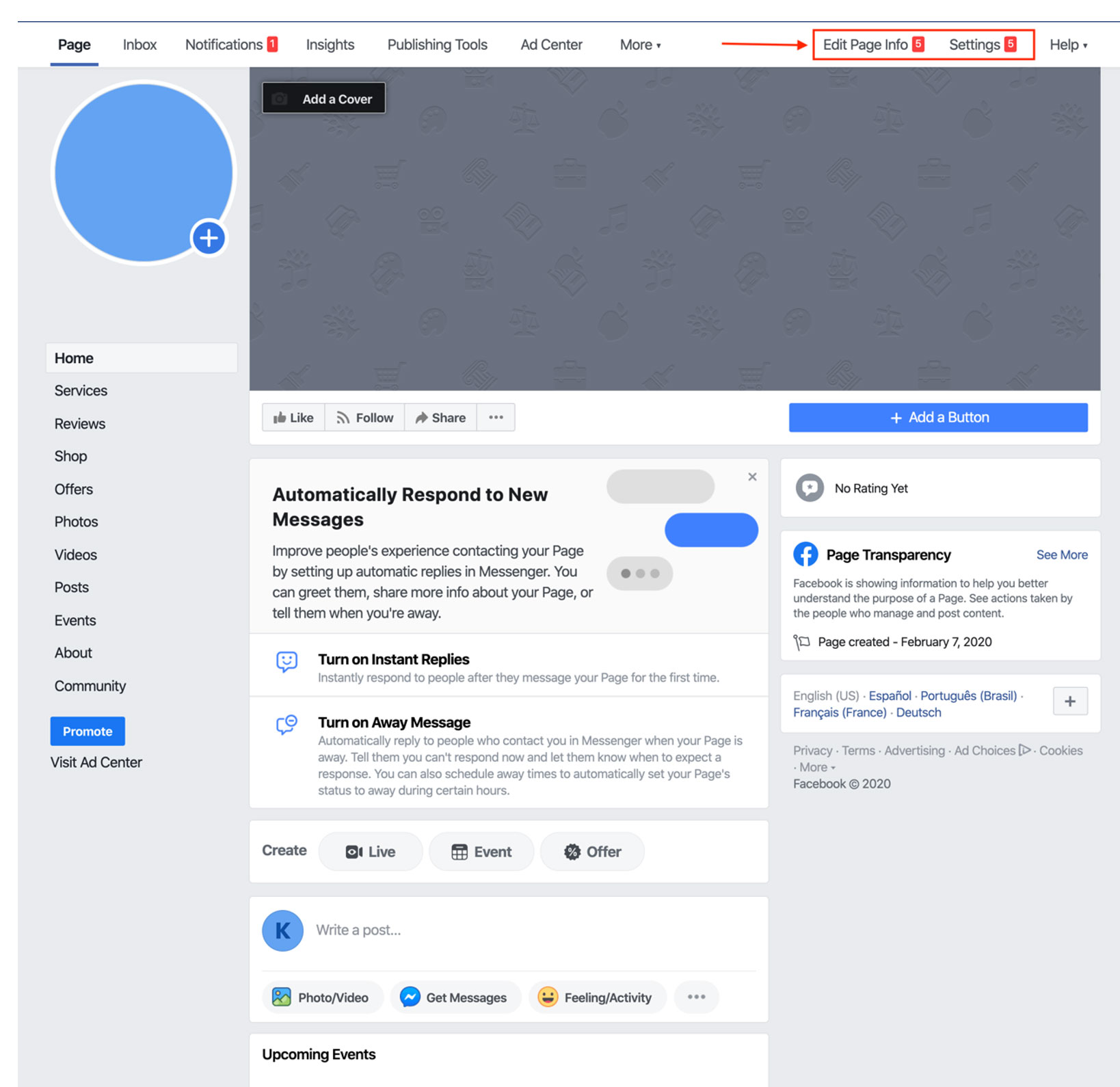

Then, you’ve created your Business Page. Just follow the prompt to fill in all necessary information. Congratulation, you’ve finished creating your Facebook Business Page.

B-4 Setting up your Facebook Ad Manager:

This step will help you setup your ad account, if you already have one, please skip.

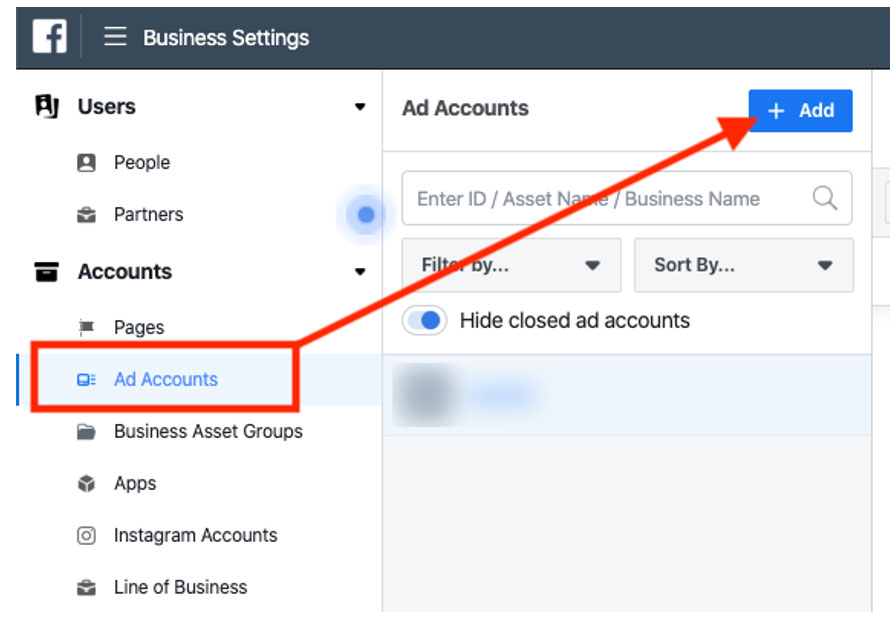

In your Facebook Business Manager settings, navigate to Accounts, then click on “Ad Accounts”, then Click Add to create a new one.

You just need to follow the on screen instruction, fill in all of the information and plugin a credit card. Then you’re ready to move on to the next step.

B-5 Setup your Facebook Pixels:

- To track the performance of your ad campaigns, you will need a little code snippet called Pixels.

In your Facebook Business Manager, click on Data Sources, then select Pixels. - Click Add to create new Pixel tracking

- After that, select Set up the Pixel Now

- We highly suggest you send the Pixel code instruction to your website developer to have it installed properly.

- Then, congratulations! You’re halfway through it and now ready to create your first ad.

![]()

B-6 Create your first Campaign and ads.

When you first create a campaign, you’re greeted with a series of Objectives in 3 primary groups:

- Awareness

- Consideration

- Conversion

This is the way Facebook guide you to create a lead funnel. First you let people know you and your brand, then influence their consideration, and finally convert them to ultimately complete the action you want them to.

So, if you’re a new agent, or have never ever set foot in your farm and want to start making some noises, you can start with Brand Awareness or Reach Objectives. This will train the campaign to reach as many people as possible within your targeted location and targeting criteria (more on this later).

In the Consideration group, you will have the following:

- Traffic: serve the ads to the people who are likely to visit your landing page (traffic to your landing page)

- Engagement: serve the ads to the people who are likely to engage with your ads.

- App installs: If you have an app and want to promote your app, this is the right option for you.

- Video Views: serve the ads to the people who are likely to watch your videos

- Lead Generation: serve the ads to the people who are likely to fill in your Facebook Lead Generation form.

- Messages: encourage people to send message in the ads by having a ‘Send message’ button in the post. This will connect them directly to your Facebook messenger to start a conversation. This option is powerful if utilized correctly because it opens a direct message channel to the audience.

In the Conversions group, there’s only one objective you should be focusing on: Conversions.

At this point, you may ask: ‘What is conversion in Facebook?’

It’s an action audience completed on your website / Facebook that you define. It can be anything from visiting your website, viewing a particular section of your page, click a button, or fill in a form. If the action take place outside of Facebook platform (for example: your website), the Facebook pixels you installed on your website will handle the tracking and record those actions.

Getting back to the Conversions Objection: This option allows Facebook to optimize the campaign to serve to those people who are likely to complete those actions before. That’s where the catch comes in. When you first launch your campaign, FB has no historical data on your pixels to know what types of people will likely to convert on your account. Therefore, it will start the campaign in other objectives mode and will likely serve to everyone within your pre-determined target audience. That’s not ideal because it will eat through your budget quickly without getting any results.

For example: If you set the conversion to fill in lead form on your website, and before that, you don’t have your pixels record who did that, then FB has no clue who it should serve the ads to. The AI needs to have some historical data to work its magic.

Warming up the Pixels:

As a result, the most common practice of Facebook advertisers is warming up the pixels, meaning giving Facebook historical data by running campaigns with easy to achieve conversions in the lower tier.

For example: create conversion actions for video views or website clicks instead of form filling.

When you have at least 50 conversions in the lower tier, that’s when you know your Facebook pixels is trained and ready for higher action.

The rationale for this type of action is: People who already watch your videos tour will likely engage more with you or have good impression with the property and the chance they contact you for a showing is higher.

That’s then you can create new custom audience in Facebook and target specifically those people only. The campaign will likely cost less and yield more results.

B-7 Test- Test and Keep testing:

You must be consistent and put everything to the test. One of my fellow marketers once said: “Wanna know the technical (and professional) term for when you hit your goals on the first try? Here it is: MIRACLE.” Marketing is half math and half psychology. You have to figure out what people want and then find a way to give it to them, at a profitable rate.

That’s why you should test multiple ads and hit the target audience at multiple angles.

If your listing has some unique selling points, use that to your advantage. Some people like pools, some like hilltop view, some prefer ocean views. Use those unique features and create video ads and serve to those audience. It sounds very simple, but many people tend to forget or find it too complicated to create custom videos like that.

One simple method used by many successful advertisers is the 3-8-8. That means you must create:

- 3 campaigns with 3 different objectives

- 8 adsets in each campaign. Each adset has different targeting options (to see which targeting option works best for you)

- 8 ads per adset.

If you do the math, the total number of ads can easily reach 192 if you want to test both Targeting and Ads variants. In many cases, this is simply too much to setup and require lots of budget to test. This works well in case you have a 30 million dollar listing but won’t work with small listings due to the number of investments involved.

Therefore, the best compromise is to start small with 1 campaign objective (traffic to your landing page), then 4 different ad sets and 4 ads in each adset.

After running the ads for 24-48 hours, you can clearly see which one perform better and pause the bad ones.

Closing Thoughts for Real Estate Agents:

Now that you have some ideas of how to run FB/IG ads. It’s time for you to dive in and create your first campaign. There’s nothing beneficial for you than to practice yourself and get familiar with one of the most potent tools in the marketing world. Learn how to do it is hard, but the reward is well worth the effort.

And if you fail the first time, try and learn again to improve because many successful agents are using FB / IG to crush the competition. If they can do it, we can do it.

eXp Realty Agents Build Wealth Through Multiple Levers Including Commission, Revenue Share, and Stock Offerings in 2021

eXp Realty has been focused on innovating and supporting agents in a virtual world since the very beginning. That’s why the brokerage has built its foundation on a state-of-the-art online platform to eliminate the traditional brick-and-mortar offices in favor of a cloud-based brokerage. That way, eXp can offer agents equal opportunity to build true wealth through virtually limitless earning potential. Every other real estate broker out there allows you to build one single income stream that comes from trading your time for money. Therefore, as soon as you stop showing properties all day long or stop picking up the phone late at night, you will stop receiving income. With eXp, you have most advantageous capped commission structure to build a successful real estate career then add in a passive income stream through revenue sharing program and become shareholders at eXp Realty in a variety of ways.

In this article, we will cover the following:

- eXp Commission – Equal Opportunity

- Transaction Fees

- Revenue Share

- eXp Stock Ownership

- Other Fees

- ICON program

eXp Realty Commission: Every Agent Has the Same Commission Structure at eXp

Unlike traditional brokerages where commissions are variable and often depend on an agent’s negotiating skills, production or relationships, all agents at eXp get the same commission structure: 80/20 with a $16,000 cap. Team members are eligible for one-half to a one-quarter cap, based on team performance.

That means agents at eXp keep 80% of the commission earned until they have paid a total of $16,000. After that, the agent keeps the entire commission (100%) for the duration of their anniversary year. There are no franchise or royalty fees charged at eXp Realty.

Transactional fees, charged only for closed sales, cover the broker review ($25) and risk management fee ($40) together capped at $500 per year.

See examples below for how commissions and costs break down.

The risk management fee caps at $500 and then goes to $0. The capped transaction fee reduces to $75 per transaction after $5,000 has been paid.

Example 1: Commission and fees for a $350,000 closing with 3% commission for an agent who has not reached the $16,000 cap:

Gross Commission = $10,500

- Deduct eXp Company Dollar = $2,100 (20%)

- Deduct Broker/Risk Fees = $65

Agent Net Commission = $8,335

Example 2: Commission and fees for a $350,000 closing with 3% commission for an agent who has reached the $16,000 cap:

Gross Commission = $10,500

- Deduct eXp Company Dollar = $0

- Deduct Capped Transaction Fee = $250

- Deduct Broker/Risk Fees = $65

Agent Net Commission = $10,185

eXp Realty Transaction Fees

After a real estate agent caps, they go to 100 percent and only pay $250 per transaction. If an agent pays in $5,000 in transaction fees after capping, they will move to a $75 per transaction fee for the remainder of the anniversary year.

For example, let’s say you sell 60 homes in one year with an average commission amount of $6,000 per transaction. Here is how your eXp Realty commission split would work out:

- Transactions 1-14 would be on an 80/20 split with NO transaction fee.

- Transactions 15-34 would be on a 100/0 split with a $250 transaction fee.

Transactions 35-60 would be on a 100/0 split with a $75 transaction fee.

To explain, you would cap on your 14th transaction ($6,000 x 14 transactions = $84,000). Transactions 15-34 would all be at $250/per transaction totaling $5,000. Transactions 35-60 would be at $75 per transaction.

eXp Revenue Share: Agents Earn Revenue Share Through Sponsored Agents

Perhaps one of the most exciting, yet misunderstood benefits at eXp is revenue share. The revenue share opportunity is simply when an agent joins eXp and names an active eXp agent as their “sponsor.” The sponsor is the eXp agent who was most influential in the new agent’s decision to join eXp.

Once the new agent begins closing on transactions, the sponsor receives a percentage of the company dollar (revenue) from the sales activity of their sponsored agent. It is based on gross commission income (GCI), and is dynamically calculated and paid monthly.

This is a different concept than profit-sharing, in which certain brokerages share company profits with agents after all expenses have been subtracted from revenue. That includes costs such as rent, insurance, utilities, staff salaries, and other costly overhead charges. In a profit-share model, it often happens that a sponsored agent is productive but the office or franchise is not profitable, resulting in minimal or zero profit-share.

eXp Stock: eXp Agents Can Acquire Stock in a Variety of Ways

The third unique form of compensation for agents at eXp is becoming a shareholder with the company. eXp Realty agents are awarded or can earn shares of stock in eXp World Holdings (eXp Realty’s parent company) after certain milestones are reached, including:

- Closing on the first transaction as an eXp Realty agent ($200 stock award)

- The first closed transaction by any agent they have sponsored ($400 stock award)

- Reaching the annual cap ($400 stock award)

- Reaching ICON Agent status ($16,000 stock award)

- Agents can also elect to receive up to 5% of their commissions from each closed sale in the form of eXp stock at a 10% discount through the Agent Equity Program.

Other eXp Fees

eXp Realty fees consist of monthly and transaction fees. I’ll cover each in more detail below.

eXp Realty does not charge a desk fee, royalty fee, or franchise fee. Also, there are no minimum production or attraction requirements. So long as you stay current on your $85 monthly fee and all state licensing requirements you can remain licensed at eXp Realty.

Risk Management Fee (Errors & Omissions)

Many agents are familiar with the term errors and omissions. At eXp Realty, we call this the risk management fee. The risk management fee varies by country, but in the US, it is $40 per transaction.

Once a real estate agent hits $500 in risk management fees paid for the year, the agent will no longer pay risk management fees for the remainder of the anniversary year.

Broker Review Fee

All US agents pay a $25 per transaction broker review fee.

This fee does not cap.

eXp Realty Mentor Fees

Agents who’ve completed less than three transactions in their current market will be enrolled in the eXp Realty’s mentor program. Agents in the mentor program are assigned a certified mentor who will help assist with the agent’s first three transactions at eXp Realty.

Mentees pay an additional 20 percent split on these first three transactions which pays the mentor and mentor program (which consists of additional training modules for the mentee).

Once the mentee closes three transactions with eXp Realty, they graduate from the mentor program and are not subject to the additional 20 percent commission split.

eXp Realty Seller Fees

eXp Realty does not charge any additional fees to clients. Agents can determine their commission rate and any additional fees to their clients. However, whatever rate and fees that are charged to the client are then split with eXp Realty at the typical commission split.

If an agent wishes to discount their commission rate and that agent has not reached their commission cap, the minimum transaction split to eXp Realty is $500. Therefore, an agent can reduce their commission completely to $0 to the client but the agent would then be responsible to pay eXp Realty $500 for that transaction, plus the broker review and risk management fee.

eXp Realty Personal Deals

At eXp Realty, agents can complete three personal transactions per year without paying the 20 percent split to eXp Realty.

Agents are only responsible to pay a $250 transaction fee, $40 risk management fee, and $25 broker review fee for the personal deal.

A personal transaction consists of only the deals for which the eXp Realty agent is personally on the contract.

Commission Split and Fees Example on 60 Transaction for the Year

Their total eXp Realty Commission Split paid for the year would equal:

- $16,000 – Cap

- $5,000 – $250 Transaction Fees

- $1,875 – $75 Transaction Fees

- $500 – Risk Management Fees

- $1,500 – Broker Review Fees

- $24,875 – Total eXp Realty Commission Split Fees

How would you like to earn $16,000 of those fees back? Read below about the ICON agent program at eXp Realty and see how you can do just that.

$500,000 Annual Gross Commission Income Plus ICON Qualifying Fee

The second way you could qualify to become an ICON agent is by achieving an “Annual gross commission income of $500,000 or more with a minimum of 10 closed transactions and payment of an “ICON Qualifying Fee.” This fee is equal to $5,000 less capped transaction fees paid during the same anniversary year.

The last part of becoming an ICON agent is to” Demonstrate company culture by giving back by teaching a class, serving on a panel, or serving on a committee. Also, an ICON agent must have a willingness to promote eXp Realty within their community.”

That’s it! Once you’ve accomplished the above requirements, you would earn $8,000 in publicly traded eXp World Holdings (EXPI) common stock. This stock vests after three years.

You would acquire an additional $4,000 after one year, once your cultural requirements are fulfilled and verified.

ICON agents earn the last $4,000 in stock awards after attending each of the two annual eXp Realty events .

The company issues $2,000 after each company event (The eXp Shareholder Summit and EXPCON ) with no vesting period, for a possible total of $4,000 from attending the company events.

Wrapping Things Up

In conclusion, the eXp Realty Commission Split is very generous compared to the majority of brokerages out there. Especially when you consider the ICON Agent Program, eXp Realty is genuinely unique. Combine this with all the tools and training that eXp Realty provides to real estate agents, and you get an excellent opportunity to grow your career in real estate.

Do you have any questions related to the eXp Realty Commission Split? Put them in the comments below and I would be happy to answer them! Also visit Express Cash Flow.

What Is A Commission Advance?

Key Takeaways:

- Commission advance is getting the commission before closing

- Commission advance is not a loan

- It is commonly used to bridge the gap between closings

- The price of commission advance varies wildly depending on how companies’ policy

1. Commission Advance definition:

By definition, a commission advance is a financial service whereby you sell a portion of a pending commission for a fee. In exchange, funds are advanced to you before closing. It’s not a loan. It’s simply access to the commission you’ve earned without the wait! Get your commission whenever you want.

2. Win-Win Pricing:

The fine print may vary, but the essence of each is the same. The first step is getting a property under contracts. Once you’ve done that, congrats, you are now potentially eligible for an advance. So let’s consider how the pricing works.

The one-size-fits-all model:

Each company has different policy. Many have opted for a simple fixed pricing structure to avoid headaches. The telltale sign is a pricing slider on their website. This has both pros and cons. At first glance, while it seems to provide an easy estimate of how much a commission advance will cost, this one-size-fits-all pricing model leaves no room for negotiation. In fact, top producers can easily enjoy a much lower rates if their productions history is taken into the account. What if a realtor is just having a rough quarter and cannot fit in the pricing model? He/she will be denied immediately.

The Custom Pricing Model:

Every transaction is different, so why have a one-size-fits-all? Custom pricing model use a risk-based pricing plan to review each commission advance request. That means the production history, details of the transaction, and closing dates, as well as other verifications are taken into consideration to create a tailored solution for that one advance. The question is: why do a lot of work just for a simple advance? It’s simple: once you look deeper into the case, the underwriter can see the agent as a real estate professional, not just a number in a spreadsheet. By adding the human factor to the mix, this model can approve more cases and also lower the rates significantly for top producers. It’s simple, the lower the risk, the better the rates.

Express Cash Flow is one fine example of custom pricing model. Once an application is submitted, ECF proprietary AI Modeling analyzes over 200 attributes to create a custom risk profile for your unique situation. Then, an underwriter will thoroughly assess the case to create a custom pricing model tailored to your needs. Some of the primary attributes to look at are:

- Your production history

- Details of the transaction

- Expected closing date

- Verification & review of all publicly available information

The result is up to 30% reduction in advance fee and a faster processing time since everything is automate in the beginning and the underwriter only need to review the information at the end.

3. Get your money faster!

If you are approved, you’ll be presented with an offer of an advance on your commission. You will receive the commission advance agreement via DocuSign that you and your broker will sign (or by you, if you are your own broker). You will be funded within hours via wire and not ACH. A good commission advance company will be able to fund you the same day. You should expect simple paper work, no credit checks, and most importantly, no massive stack of loan documents to sign. At Express Cash Flow, the entire process from Application to Funding can take place within 4 hours. There are no partial holdbacks like some other companies.

4. Paying back the advance:

Technically, when you get funded, everything is taken care for you. The advance is automatically paid back when the escrow or settlement company closes. The amount is equal to the advance plus the fee. That means you never pay anything out of pocket. You get the much-needed liquidity to grow your business and thrive.

5. What if escrow falls out?

It is nothing to worry about. While doing market research for commission advance, we found out most companies are smart enough to give the advance to those who are likely to close the deal. After all, advance companies want to make money and avoid any foreseeable risk. At Express Cash Flow, after more than $3 billion property worth of advance, we have a 99.5% closing rate of all advances. Our AI underwriting model optimize the process and reduces the risk of deals falling through. Even if the deal falls, you can simply switch your advance to another escrow for a minimal fee (no hefty penalties or immediate payback requirements).

6. How much of my commission can I advance?

You can advance up to 75% of your *net* commission. Your net commission is determined by calculating the total gross commission, and then removing the portion due your broker, plus any office, TC, franchise or referral fees, i.e. the money that would be going into your pocket. So if you have a $500K transaction with a 2.5% commission and are on an 80/20 split, your gross commission would be $500K*2.5% or $12,500. Your net commission would be $12,500*80% or $10,000, and we would be able to advance 75% of that ($7,500). You can take less than this if you’d like, but $7,500 would be the maximum advance amount

7. Is there a minimum advance amount and a minimum fee?

Yes. Statutory guidelines dictate that the minimum advance amount is $2,500, so you’ll need to be earning a net commission of at least $3,000 in order to qualify for an advance. The minimum fee, which usually applies on advances of up to $5,000 for less than 30 days, is $400. Please note that this for every outgoing wire, so if you want $5,000 for 25 days or $2,500 for 2 days, the fee will still be $400. Proper planning can help you get the most efficiency out of our fee structure.

Summary of Benefits of Using Express Cash Flow:

- Get to 75% of your commission on the same day

- No credit checks

- No out of pocket charge

- No hold-backs, no hidden fee

- Agent friendly pricing

- Personalized service

We know you don’t all need a commission advance, but we could all use a little extra cash every now and then, and we hope you think of Express Cash Flow whenever the need arises.

Apply for commission advance today.